|

23 June 2014

Posted in

Special research

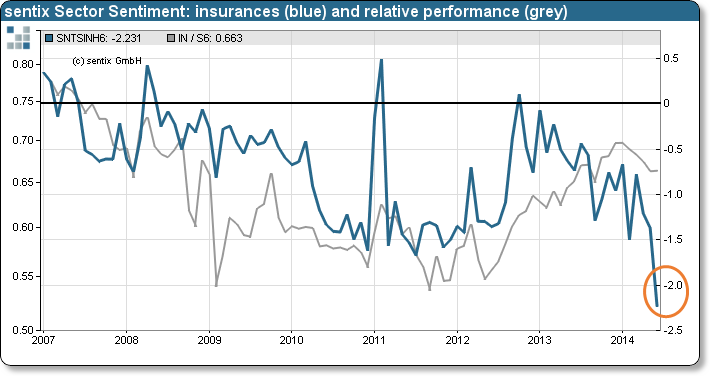

About two weeks after the latest ECB's rate cut sentix Sector Sentiment for insurance stocks falls more strongly than for any other sector in June. It has now reached an all-time low. At the same time, insurance stocks as a whole do not show any pronounced relative weakness. That makes them currently look like an opportunity.

sentix Sector Sentiment for European insurance stocks falls by 0.86 to now -2.23 standard deviations (see "background" below for an explanation) – this month's largest sentiment decrease within all 19 sectors in the survey. In addition, this is the lowest reading for insurance stocks since the introduction of the indicator in 2002.

The media discussion about the "abolishment of interest rates" in the euro zone accompanying the latest rate cut by the European Central Bank has strongly influenced investors' perceptions. Meanwhile the latest German political initiatives to support insurance companies in the current environment of ultra-low interest rates has not had a positive impact. On the contrary, it obviously has directed the attention of many investors to the sectors' problems, a sector whose major players like Allianz, for instance, have not displayed convincing stock performances recently.

But overall, the performance of European insurance stocks against the whole market was stable during the past weeks. Since the beginning of the year relative performance here does show some weakness, but the drop in sentiment looks much stronger in relation to that. Also, sentiment now is so low that it has to be interpreted as a contrarian signal. Consequently, sentix data currently make European insurance stocks look attractive.