|

22 July 2014

Posted in

Special research

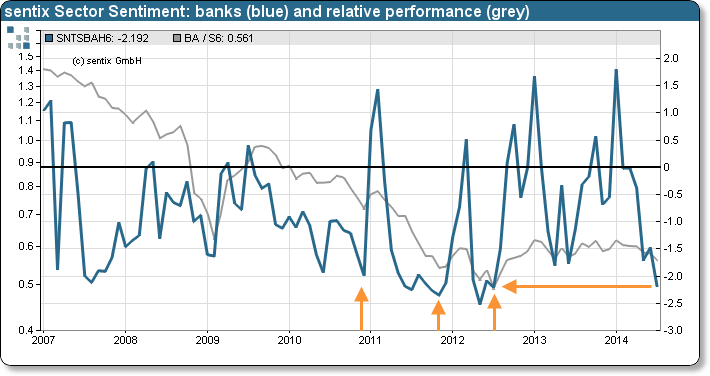

sentix Sector Sentiment for European banks falls to its lowest level since July 2012. That was when the euro-zone crisis was close to its climax and urged ECB president Draghi to famously fully commit to the euro. The extremely bad sentiment is now an opportunity for contrarian investors.

sentix Sector Sentiment for European bank stocks falls markedly in July. It slips by 0.7 to about -2.2 standard deviations*. This is a level which could last be observed just before Mario Draghi's well-known euro commitment at the end of July 2012.

Interestingly, at the year's start sentix Sector Sentiment for banks had reached an all-time high. This euphoria has not only vanished in the meantime, it has even turned itself into the opposite – against the backdrop of the publication date of the stress test results (due in October) coming closer and closer. Over the past months there were a lot of negative news concerning individual institutes, too. In July, it is now the Portuguese Banco Espirito Santo which chiefly contributes to a further shift in investors' perceptions to the negative.

The extremely bad sentiment for bank stocks now is an opportunity for each contrarian investor. 2010, 2011 and 2012 such low sentiment readings were followed by several months of outperformance of the sector against the market (see graph). But what remains open is the question which commitment Mario Draghi will deliver this time for its support.