|

24 January 2018

Posted in

Special research

Investors are showing an unprecedented level of risk in their equity exposures. An indicator of this is rather the pre-ferred investment themes and styles than the total equity exposure. Especially stocks in the emerging markets are very popular with investors. Furthermore, investors increasingly see IPOs as a promising investment opportunity. In addition, investors are more and more pro-cyclical.

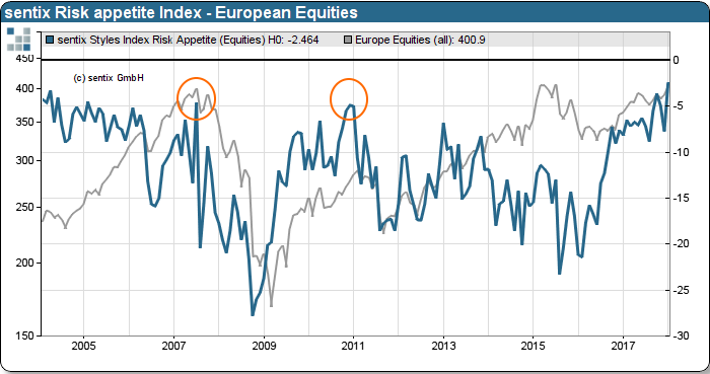

The sentix Styles Index "Risk appetite for equities" shows the willingness of investors to take risks on the equity market. The willingness to take risks is not derived from the level of their equity exposure, but rather from the preferred investment segments and investment preferences. The current survey shows that the risk appetite has increased significantly. The index reaches a new all-time high in the history since 2004. Investors are increasing their appetite for risk by expending emerging markets exposure. Additionally, investors increased their preference for initial public offerings and shifting their focus away from dividends to price gains. A pro-cyclical style of investing - i. e. in the direction of the prevailing trend - is also increasingly being given as a preferred method by investors. Overall, the risk appetite continues to increase.

sentix Styles Index – Risk appetite European Equities

In the past, such a high risk appetite was often a harbinger of imminent corrections or even trend reversals (see marks on the chart). More and more central banks intend to leave their expansionary course due to the good economic situation. This should increase market volatility. A risky investment behavior could be punished in such a scenario.