|

16 April 2019

Posted in

Special research

The real estate industry is currently strongly represented in public reporting. While tenants in major German cities are focusing on the industry's high profits, investors are rethinking. Sentiment is turning clearly southwards and the relative strength of the sector has also turned strongly. The spotlight into which the sector has fallen doesn't seem to be getting him well.

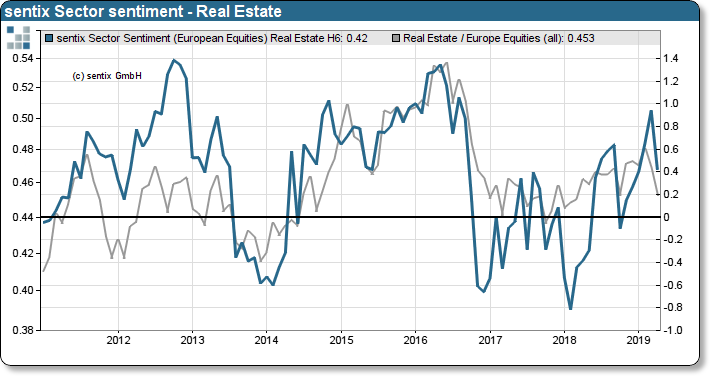

Twice in the past nine years, sentix sentiment for the real estate sector has been quoted at around 1.4 standard devia-tions: 2012 and 2016. In both cases, a relative phase of weakness lasting several months followed. The mood hasn't been as positive as it was back then, but even a month ago we were still quoting very bullish investor expectations. This changed noticeably in April. The discussions about possible expropriations of large companies in the industry have led to a considerable relative weakness and a turn in investor expectations. Since investor sentiment is usually a reflection of investors' positions, this rethinking should lead to further sales. The material is still available.

sentix sector sentiment real estate vs. relative performance real estate vs. STOXX 600

Even seasonally, real estate stocks tend to be below average until the end of May, before June and July as strong sea-sonal months show an improvement again. Real estate stocks are currently in the limelight, but in the short term they are under rather negative signs.