|

17 October 2016

Posted in

Special research

Investors’ opinion on the euro currency has fallen to the lowest level since “Brexit”. Despite that comparable pessimistic sentiment readings point towards an immediate reversal, current portfolio setups do not fully support investors’ sentiment, yet. Hence, in the next weeks, the euro should continue to show relative weakness.

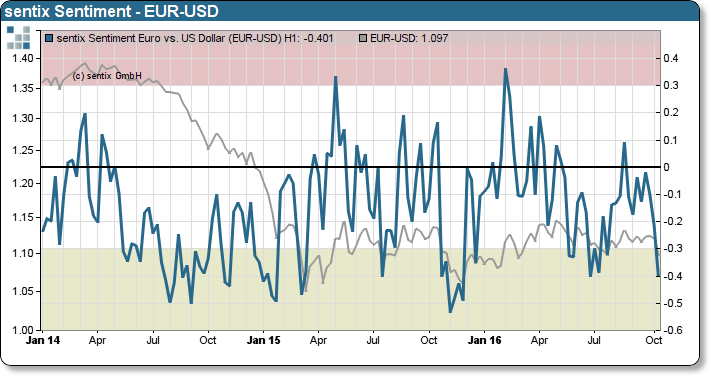

The Euro US-Dollar exchange rate has slipped in recent days due to iterative comments by US Fed officials maintaining the general willingness to tighten monetary policy further. As a consequence, the sentix Sentiment Index for the Euro US-Dollar exchange rate reached an extremely bearish realm. In comparison to the previous week, the sentiment indicator has fallen significantly by -0.4 points to the lowest level since June 2016 (refer to the chart, blue line). Such pessimistic situations are contrarian buy signals and historically followed by quick reversals. During such setups, worried investors have left the market. Selling pressure eases as more “bulls” quit the field.

The current circumstance, however, is somewhat unusual. The uncompleted process of portfolio rebalancing currently hampers a sentiment driven reversal. While investors’ sentiment has already reached extremely bearish realm, investors’ portfolios have not completely adjusted pro-USD, according to the positioning data provided by the CFTC CoT.

Hence, we expect that it might take up to two to three weeks before a balance between investors’ portfolios and their sentiment level will be re-established. Afterwards, a sustainable reversal is possible.