|

15 April 2020

Posted in

Special research

The measures taken by governments worldwide to combat the corona pandemic through decisive action and excessive fiscal and monetary measures are viewed positively by investors. But there is one area where concerns are growing!

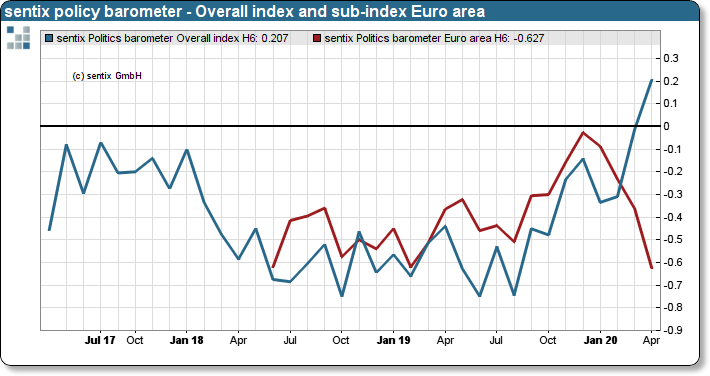

In the sentix policy barometer we regularly measure how investors assess the impact of policies in various areas on stock market developments. The areas we regularly look at include Brexit, geopolitics, euro policy and US President Trump. In all sub-indices, investors assess the political influence more or less negatively. Nevertheless, the Headline Index, in which investors rate politics as a whole, can rise significantly. This is a strong indication that investors are ob-viously very much in agreement with the political action taken in the Corona crisis. From an investor's perspective, the generosity and speed with which fiscal and monetary measures were introduced may have been the deciding factor.

sentix policy barometer - Overall Index and sub-index "Euro area”

But the policy barometer also contains a clear warning, namely with regard to the Euro area. As in the last publication of the sentix Euro Break-up Index, which documented a noticeable increase in the risk of a break-up of the Euro zone, investors are once again expressing their displeasure about the current Euro zone policy. The Italian government's attitude of spurning funds from the ESM is leading to a development that could have a negative impact on the equity markets from an investor's perspective.