|

16 July 2018

Posted in

Special research

We observe a very rare phenomenon at sentix: the US stock markets are going up, the Nasdaq is climbing from one all-time high to the next - only the enthusiasm of investors is missing. The reasons are "fundamental".

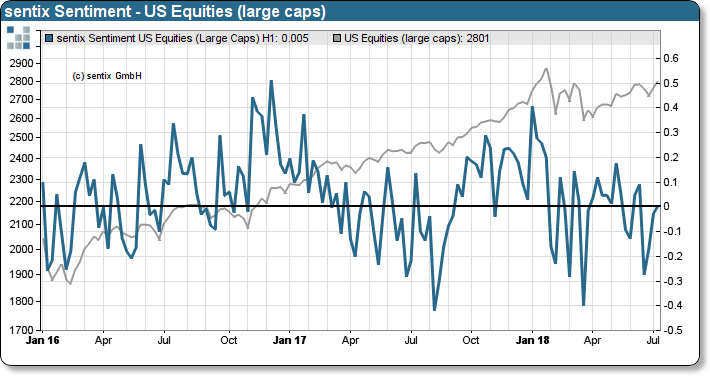

Courses and moods regularly move in sync with each other. This basic rule is currently being turned upside down. Looking at the sentiment for US equities reveals that despite the recovery rally, which has once again been stronger in the US than in Europe, there is no euphoria. Rather, the sentiment is just neutral, the trial of strength between bulls and bears is thus completely balanced.

sentix Sentiment US Large Caps and S&P 500

Investors obviously cannot enjoy the rise in equity prices. That's because you don't have the prospects. Tariffs, rising interest rates and now the threat of an economic slowdown. This mix is hard on the shareholders' stomach and spoils the party atmosphere. The tummy rumbling can be observed nicely in the Strategic Bias for US stocks. The indicator measures the basic conviction of investors (not shown) and therefore has a leading characteristic. What is worrying is the weakness that has been apparent there for many weeks. The development of the basic conviction recalls the years 2008 and 2011, in which a similar loss of confidence took place. Many suspect also this year that the current party is a flop. But they keep dancing until they realize too late that the music is already over.