|

04 October 2016

Posted in

Special research

After OPEC announces production cuts, sentiment among oil market participants spikes and hits a bullish level not seen in more than two years. At the same time, investors’ confidence in higher crude prices solidifies. Both signals combined yield higher crude prices in the coming months, based on past studies.

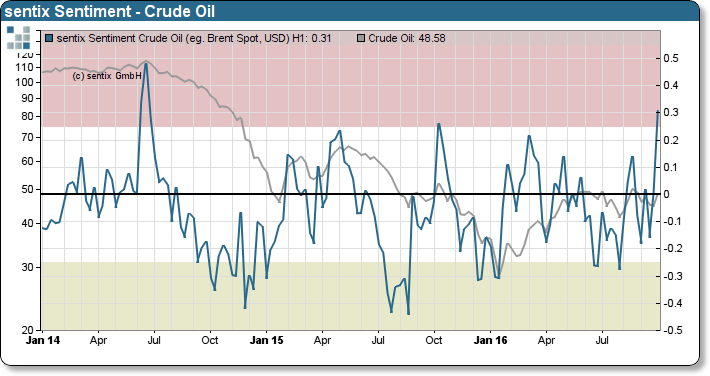

Last week’s agreement on crude oil production cuts by OPEC members in Algiers came at a surprise for most market participants. Amid the deadlock between Saudi-Arabia and Iran, current production surplus suppresses crude prices. If the agreement holds, it would be the first significant reduction in oil output quotas for OPEC members since 2008. Hence, investors turn optimistic in anticipation of a falling output surplus and higher oil prices. The latest sentix sentiment for crude oil jumps from -0.1 to +0.3 points and hits the highest level in more than two years (refer to the left chart, blue line). An impulse of similar magnitude last appeared in June 2014. A high degree of optimism on its own is a potential warning of an immediate market correction.

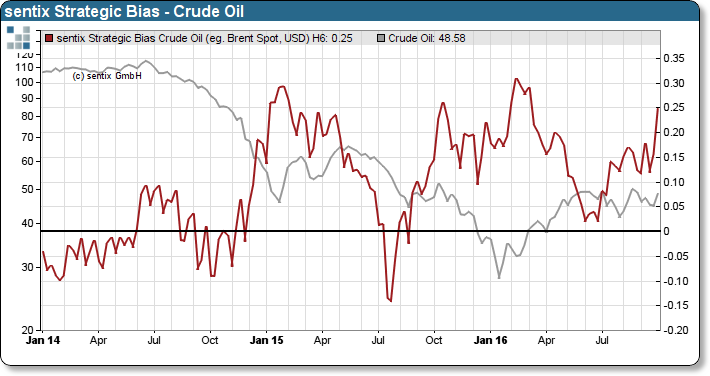

However, we currently do not believe that the crude oil market is ripe for a significant correction as an improving medium-term confidence supports investors’ sentiment advance. The sentix Strategic Bias, which measures investors’ six-month price expectations, continues to increase since May 2016. The latest survey reveals a substantial increase by +0.1 to 0.25 points (refer to the right chart, red line). Ideally, growing confidence precedes portfolio commitments and indicates that investors enter the market as buyers in rising numbers.

The coincident of strong investor sentiment and increasing confidence in crude oil supports the notion for an impending directional impulse and subsequently rising crude oil prices over a medium term horizon.