|

15 March 2019

Posted in

Special research

Once a month sentix determines the sentiment of investors regarding the most important sectors in Europe. These sentiment data provide information on investors' expectations of individual sectors, but can also be analysed in relation to other sectors. Particularly interesting are sector pairs that have a fundamental connection. Such a link exists between oil producers and tourism stocks.

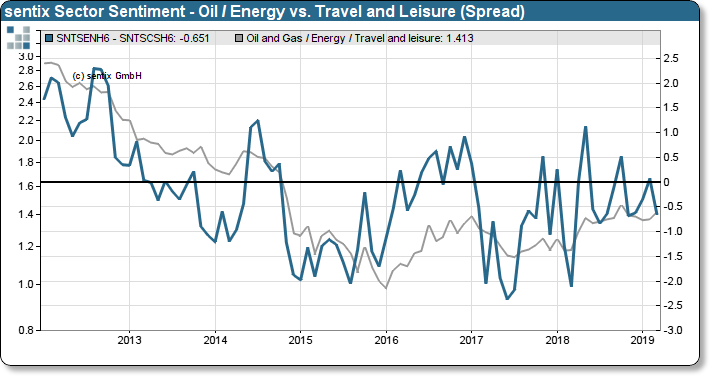

The tourism sector includes airlines and one of the most important cost factors in the sector is oil prices. The chart below shows the relative sentiment between the two sectors. At the beginning of 2018, this had formed a relative low. The sentiment for oil stocks was very poor relative to tourism stocks. Since then, oil stocks have been performing relatively better, but sentiment is improving only slowly. Especially in the last month the sentiment tilts, although tourism stocks performed weakly. This suggests that investors are refusing to accept the relative strength of oil stocks or the weakness of tourism stocks. Such a denial opens up the prospect of further relative price gains for the oil sector. Espe-cially as seasonal analysis suggests, oil is usually good until May and the tourist stocks are rather moderate.

sentix sector sentiment energy vs. tourism and relative performance energy sector vs. travel / leisure sector

It appears that 2017-2018 has seen a longer-term reversal in this sector pair. Compared with the good performance of oil stocks, investors are only moderately enthusiastic, leaving room for further positive discoveries.