|

15 May 2018

Posted in

Special research

The uncertainties in the Gulf region, which continue to be fueled by the termination of the Iran nuclear agreement by the USA, and the sharp rise in prices are leaving their mark on investors' sentiment. Investor sentiment on oil has reached its highest level since the end of 2016, and oil shares are also in high demand. But here, too, we are now measuring euphoric trends in the sector sentiment. A contrary chance is looming!

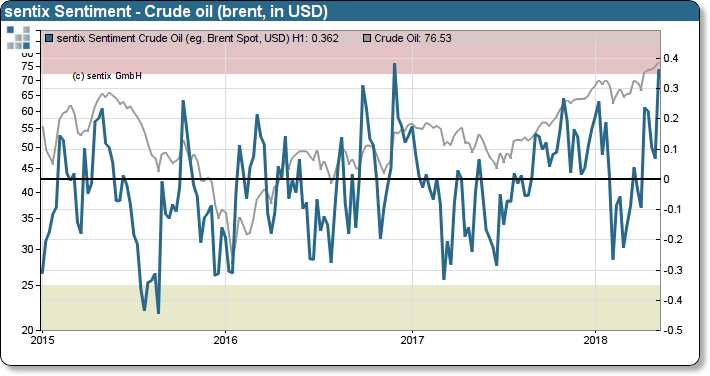

Oil prices have known only one direction for almost a year: upwards. The spot price of the North Sea variety Brent has risen by more than 60% since the end of June 2017. In addition to the good economic situation in Europe and world-wide, it is above all geopolitical uncertainties that are supporting the price increase. The US president's decision to uni-laterally terminate the Iran nuclear agreement has recently led to another surge in prices. All this does not miss its ef-fect on the mood of investors. The sentix sentiment for crude oil jumps significantly upwards and reaches +36% the highest level since autumn 2016.

sentix Sentiment for crude oil (Brent, in USD) vs. crude oil price Brent

Such a one-sided mood poses a problem for the optimists in this market. For whenever investors' emotions are too one-sided, they indicate an equally one-sided positioning or too little risk perception. This often results in corrections against the prevailing trend.

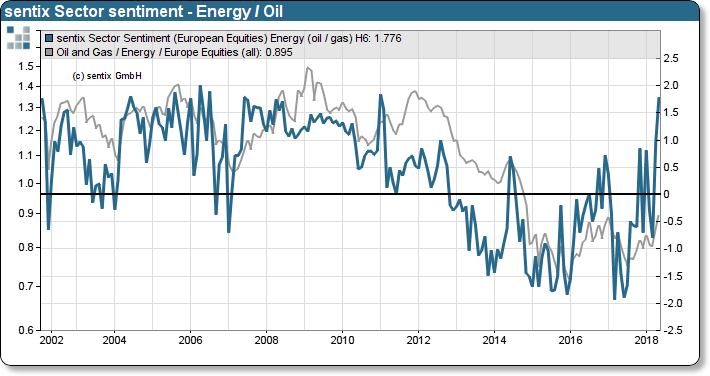

But not only investors in the oil market are impressed by the rising oil prices. The stock market is also showing an almost euphoric attitude on the part of investors. The relative sector sentiment of sentix reaches its highest level since 2011 with 1.8 z-scores.

sentix Sector-Sentiment Oil / Energy (relative) vs. STOXX600 Oil and Energy relative to STOXX600

Such a one-sidedly pronounced investor sentiment is also here a harbinger for a necessary correction. In the past, this was more than 5% on average over a period of 3-6 months.

Investors are therefore well advised to perceive the euphoric mood surrounding oil as a risk factor.