|

22 June 2015

Posted in

Special research

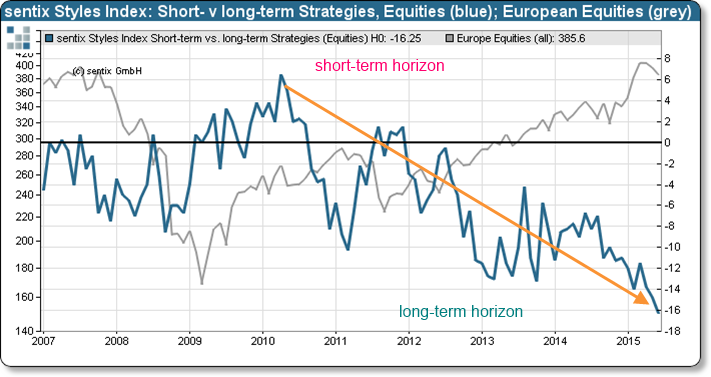

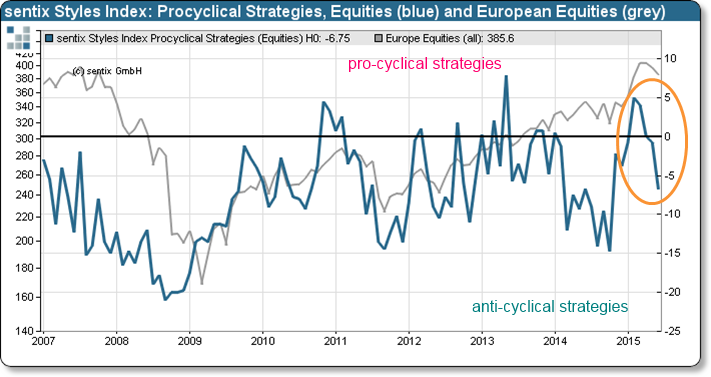

The sentix data universe makes it clear: investors commit in an increasingly strong manner to European shares. For instance, they currently plan with an investment horizon which was never longer than today. In addition, stock market participants behave rather anti-cyclically at the moment. Both is positive for the asset class.

In June, the sentix indicator regarding the time horizon when investing in stocks falls to a new record low (see graph on the left-hand side). This means that investors’ intended holding period when buying stocks was never longer than today (since inception of the indicator in 2004) which underscores the outspoken resistance of the European equity market. And it also makes a strong case for the asset class.

Furthermore, this month the sentix index concerning pro-cyclical equity strategies falls, too (see right-hand graph). Consequently, stock investors again act more anti-cyclically. As their basic conviction has just risen, this also has to be seen as a strong commitment – because it shows that investors want to buy stocks again in the current correction. Overall, bullish signals for European stocks thus intensify!