|

03 May 2016

Posted in

Special research

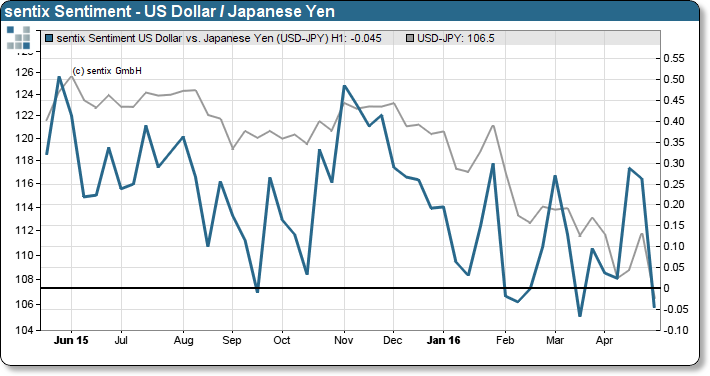

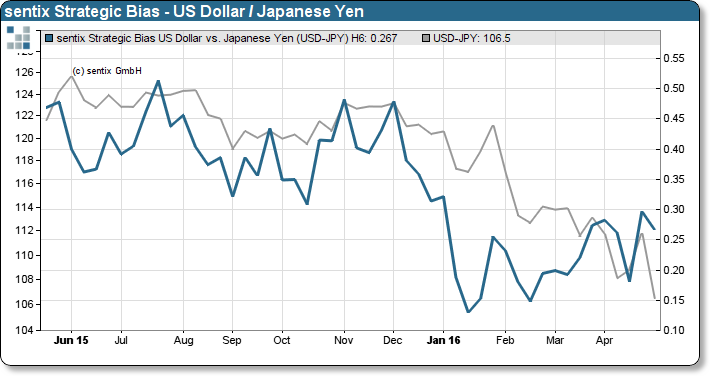

The reaction of investors to an absence of further quantitative easing by the Japanese central bank has been significant. The latest sentix Sentiment for the USD/JPY exchange rate drops by 31 percentage points. Albeit investors’ confidence in the USD remains stable. A promising setup for a rising USD/JPY exchange rate over the medium term.

The latest sentix Sentiment for the US Dollar / Japanese Yen exchange rate dropped by 31 percentage points (refer to left chart). Investors were negatively surprised that the Japanese central bank did not announce further monetary stimulus packages. Subsequent market reactions and media echo have been vigorous. The exchange rate has lost more than 5% since April 28th. Of interest is that the disappointment is not reflected in current readings of investors’ confidence of the USD. In contrast to sentiment, which reflects the emotions of investors, the degree of confidence measures the general persuasion of an asset. Investors remain confident even after experiencing disappointment (refer to right chart – Strategic Bias).

Consequently, the diverging behaviour of both sentix indicators points to a potential short-term trend reversal. Despite the fact that investors have sold USD following the central bank announcement. However, the level of confidence demonstrates that investors are still persuaded about the long-term potential of the USD. Thus, investors should not be surprised about a USD strength over the next weeks.