|

12 September 2016

Posted in

Special research

Investors sentiment towards German government long bonds chills. EZB’s preliminary decision not to expand monetary policy disappoints investors. However, fear among market participants such as in April/May 2015 is not present, yet.

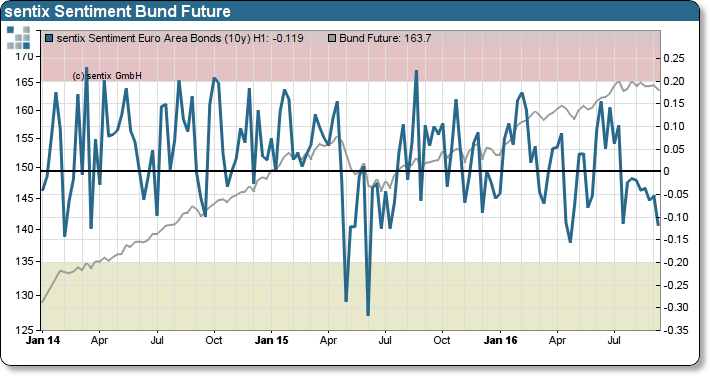

The latest sentix Sentiment Index for German Government bonds has fallen -0.07 and hit with -0.12 index points the lowest value since April. The weak sentiment reflects surging disappointment among market participants as the EZB adopts a more cautious policy. Hence, the ECB has rejected investors inflated demand for an ever looser monetary policy, at least for now. Nonetheless, since last week, investors are aware again that the ultra-loose monetary policy will not remain in force forever. Demand for hedging as well as outright bond sales has caused markets to tumble. For the first time since the outcome of the “Brexit” referendum, yields on German 10-year government bonds have turned positive.

However, since the reaction of investors to the EZB press conference is not driven by fear, as in April/May 2015, and the sentix Sentiment for European Bonds has not reached extreme parameters yet (refer to chart – green zone), hedging demand has not peaked, yet. Consequently, investors should expect a further market correction in German Bunds.