|

16 November 2015

Posted in

Special research

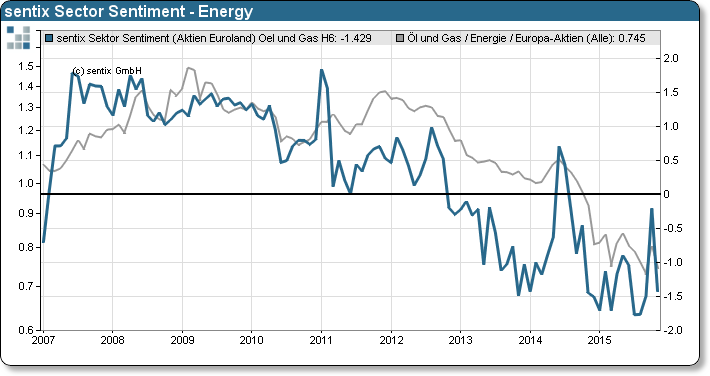

The latest sentix Sector Sentiment for European energy stocks falls significantly in November. As result, sentiment among investors bounces back to its September lows. The latest oil price rout dampens expectations.

The sentix Sector Sentiment for European energy stocks falls significantly in November. Investors have once more revised previous relative optimistic expectations for the European energy sector. Last but not least, the latest slump in crude oil prices set a premature ending to investors’ hopes for an end of the since July 2014 ongoing crude oil price rout. Not surprising, though, the sector shows “underperformance” relative to its peers. The renewed, rapid awareness raising along with investors’ uncertainty to price declines shows that “the market has already shaken out the weak hands”. The rationale behind is that investors whose opinions are not bound by market positions can adapt new information quicker.

In addition, market sentiment is more pessimistic than investors’ fundamental belief in the value of crude oil. All in all, promising evidence for bottoming out energy securities. From a contrarian point of view, the latest sentix Sector Sentiment is a buy signal.