|

24 November 2014

Posted in

Special research

Investors' preferences for dividends are as strong as never before. At the same time stocks are currently barely bought for the motive of price increases. This is what the results of the latest sentix Global Investors Survey show.

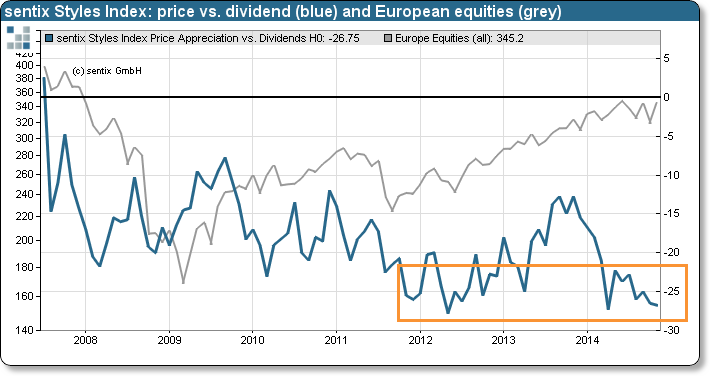

With the latest sentix Global Investor Survey preferences when investing in equities were polled. The resulting monthly indicator (sentix Styles Index: price advances vs. dividends) recedes in November and now stands close to its all-time low (see graph). This development shows that investors buy stocks currently mainly because of their dividend payments. However, price advances these days play only a minor role when engaging in the asset class.

Furthermore, it is worth of note that this year the indicator has – untypically – even after the dividend season pointed to a strong investor bias for dividends. In the current half of the year this preference is now even so pronounced as never before!

The main reason for this attitude might lie in the zero-yield environment which creates strong investment needs. And the dividend yield for most European markets still is clearly in positive territory, for the Euro Stoxx 50, for instance, it presently stands at around 3.6%. This yield serves as an incentive for investors to increasingly accept the price movements associated with stock investments. Fittingly, investors' investment horizon lengthens – a development the sentix data reflect, too, at the current juncture.