|

14 July 2014

Posted in

Special research

The results of the current sentix Global Investor Survey show that investors' risk appetite is waning. A very clear example here is the declining preference for stocks of smaller companies as mir-rored by the sentix Small Caps Index. This index falls in July and thus signals that more and more investors are turning their backs at smaller capitalisations – with the risk of a spill-over to the rest of the market.

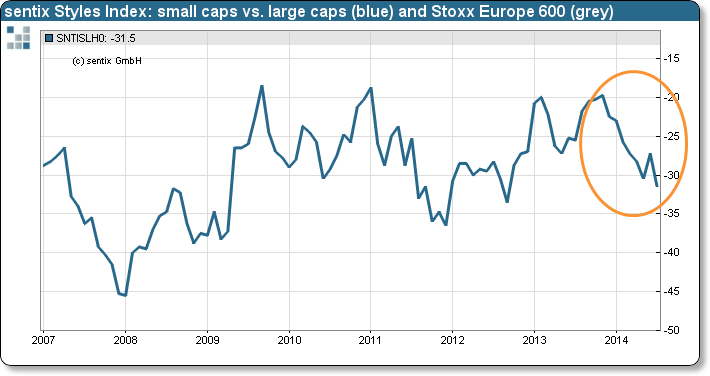

sentix Small Caps Index representing investors' preferences for small caps in relation to large ones falls to a 12-month low in July. It now stands at -31.5 points which is below average. Consequently, small caps suffer from an ever stronger degree of lack of investors' interest. The index not only shows investors' favourite choice but also a generally receding risk appetite. That investors actually turn their backs at the stocks of small and medium-sized companies has already led to a visible weakness in the German M-DAX, for instance. In contrast, broader indices like the Stoxx Europe 600 have reacted relatively little so far (see graph).

The falling preference for small caps indicates that investors have become more selective in terms of stock investments which means that their conviction for the asset class as a whole is fading. In addition, waning interest in small caps was in the past often a predictor of weakness in the less risky large caps segment. Consequently, the falling sentix Small Caps Index calls for more caution regard-ing the broader market, too.