|

11 April 2016

Posted in

Special research

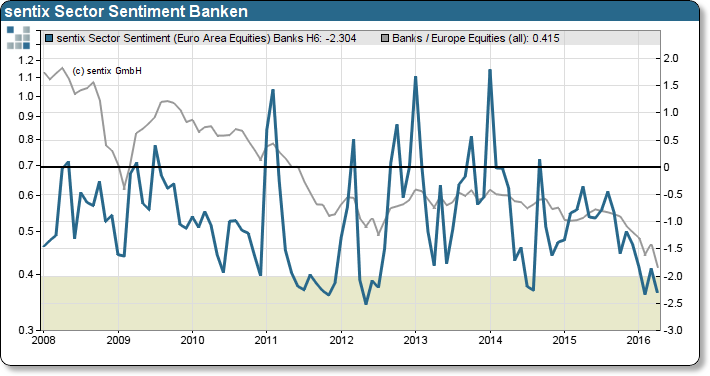

In April, investors continue to see the European banking landscape sailing in troubled waters. The sentix Sector Sentiment for European bank stocks has been as negative recently as during the heights of the euro crisis in 2011/12. A potential buy opportunity could emerge.

The sentix sector sentiment for European bank stocks has fallen back to its February level at -2.3 index points after recovering only temporarily. The re-strengthened pessimism of investors should be regarded as a reflex on the tense business expectations of some of Europe’s big banks as well as troubled euro periphery. With the prolonging of Europe’s crisis, investors react more sensitively to news from the banking sector.

The sentix Sector Sentiment measures which industry sector is en-vogue or is going to be shunned by investors within the next six months. In principle, negative indicator values lead to a weakening in the sectors performance. Extreme values, however, indicate a market move into the opposite. Investors willing to dump their holdings usually have done so, as values reach extreme territory; thus, reducing further price pressure.

The latest development of the sentix Sector Sentiment confirms that the majority of investors have turned their back on bank stocks (see chart). Based on a behavioral finance point of view, a potential buying opportunity could emerge.