|

18 July 2016

Posted in

Special research

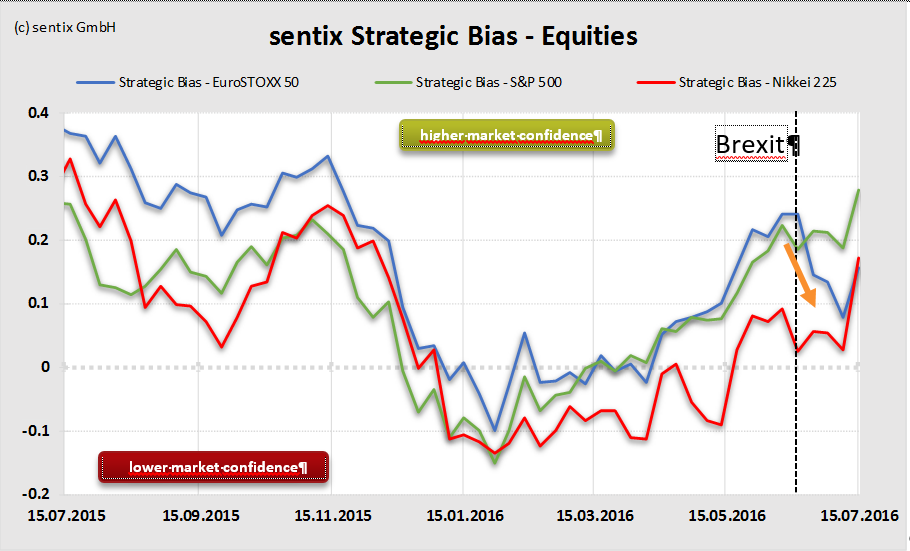

The latest sentix Strategic Bias conveys a positive implication for global equities. Investors bet on further rising stock markets as confidence mounts. Albeit, the European equity markets are trailing since the Brexit referendum.

Confidence is rising across the equity market landscape, lately. However, investors surveyed by sentix regionally differ-entiate among stock markets. Whereas the US and Asian markets manage to gain a boost in investors’ confidence, Euro-pean markets keep trailing below their pre-Brexit levels. Overall, investors express that they have gained the highest confidence in Asian and US stock markets in more than 12 months (refer to Graph, green and red line). The sentix Strategic Bias indicates whether investors accumulate confidence and the willingness to buy (for a detailed description of our indicator, please refer to the Background section). In theory, an increasing willingness to purchase stocks is a crucial com-ponent for actual long investments, ultimately leading to higher equity prices.

In addition to investors’ perception on global markets, the latest confidence buildup should stabilise European equity prices (refer to the chart, blue line). Nevertheless, investors currently prefer the US and Asian markets over their European counterparts.