|

25 January 2016

Posted in

Special research

The EZB surprisingly fails to lure investors with further monetary stimulus talks. The latest sentix Global investor survey shows market confidence in the euro among investors is on the rise – thriving expectations increase chance for euro appreciation. Is the EZB loosing investors’ confidence?

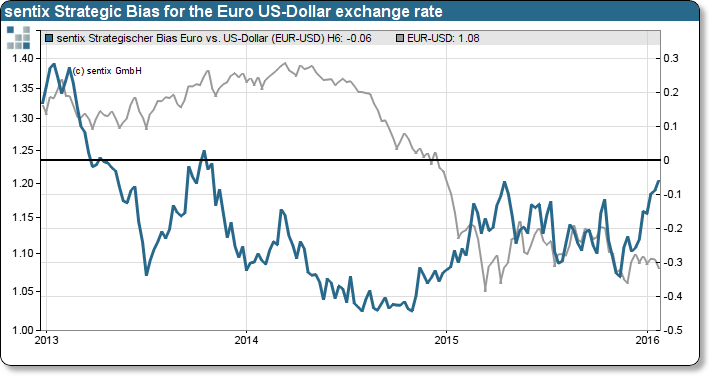

The latest sentix Strategic Bias for the Euro US-Dollar exchange rate, which measures investors’ intermediate-term market expectations (six months), rises unexpected to a new 104 week high. Hence, investors react surprisingly in opposition to EZB’s announcement to consider further monetary policy action. Confidence in the euro is on the rise and the negative effect on the single market currency, as probably aspired by the EZB, fails to materialise (see chart below). It appears that the EZB does not succeed anymore in pressing investors to sell euros in a sufficient volume to depress the euro exchange rate. Nonetheless, this development is not new. Since last November, the sentix strategic Bias has increased, contrasting the development of the exchange rate. A diverging development of the sentix indicator is, due to its leading attributes, an early signal for an immanent change in the euro US-Dollar FX trend.