|

12 January 2015

Posted in

Special research

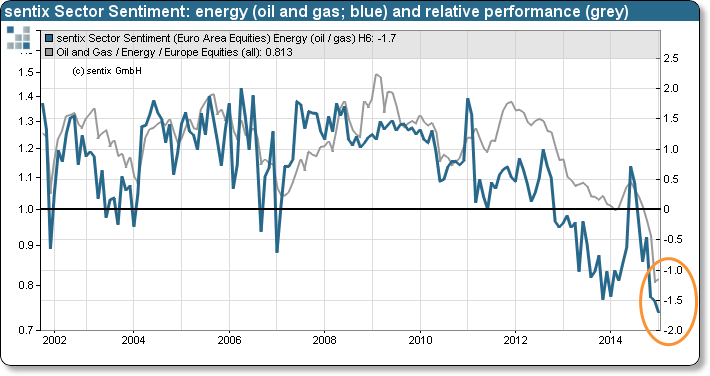

While the feebleness of oil prices continues, sentix Sector Sentiment for European energy shares falls again to an all-time low. Taken face value, this is a positive sign for the future performance of the sector's stocks. But it does not look as if energy shares could reach more than a temporary stabilisation in the coming weeks – their current price behaviour is just too weak.

In January, sentix Sector Sentiment for European energy shares decreases from -1.50 to -1.70 standard deviations (see background below). With this, the indicator reaches a new all-time low. Its downward trend dating from last summer remains perfectly intact (see graph).

The sentiment for the oil and gas sector now stands at such a low level that it has to be interpreted in a contrarian manner. It thus sends a buying signal. Actually, the probability of a rebound for the prices of energy stocks has increased.

However, the absolute as well as the relative performance of the sector's shares tell a different story. They do not give any hint for a change for the better so far. This is why we only expect a temporary stabilisation of the index for European energy shares over the next weeks.