|

10 August 2015

Posted in

Special research

Seitdem Mario Draghi die EZB auf ein umfassendes „Quantitative Easing“ eingeschworen hat, profitieren die europäischen Aktienmärkte von einem massiven Vertrauenskapital. Dieses ist deutlich größer als für andere Aktienmärkte und hat zu einer Outperformance der Euro-Aktienmärkte gegenüber ihren US-Pendants beitragen. Und dieser Trend ist noch nicht zu Ende!

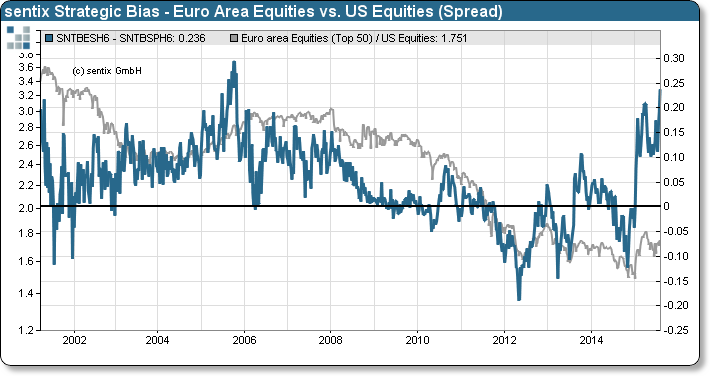

Since the end of 2014, Euro-equities benefit from a high base of investor confidence. Due to the ECB's decision to expand the money supply by a massive purchase of government bonds, this basic trust has also significantly decoupled from the trend of the strategic bias in other major markets. Looking at the spread in basic trust between the Euro zone and the United States (see following chart), it shows a massive expansion in favor of European equities.

Such a difference in the Strategic bias has an effect on the subsequent, relative performance of the markets. It there-fore is not surprising that the euro shares have outperformed in the performance since the beginning of their US counterparts. In addition, this trend is likely not yet be completed. Although the trend in the Strategic bias has lasted quite a while, he is still clearly intact. Even the trend would end now it would mean to reverse the trend in the price only after a certain delay due to the leading property of this indicator.