|

04 January 2016

Posted in

Special research

Investors’ confidence in major equity markets suffered a blow recently as analysed in the latest sentix Global Investor Survey. The strategic optimism continues to fall to a 52 week low for German equities. Likewise, confidence in East Asian equity markets have been significantly hit.

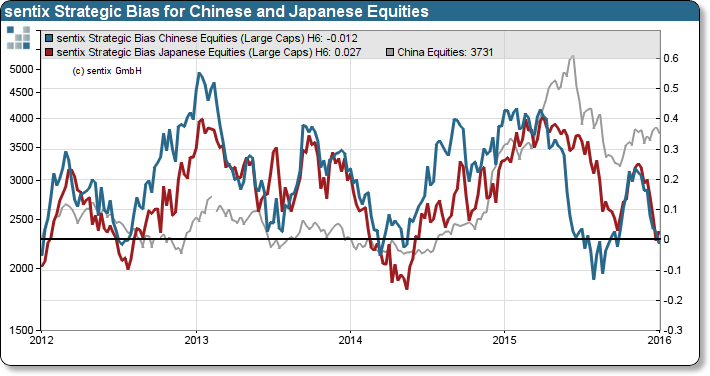

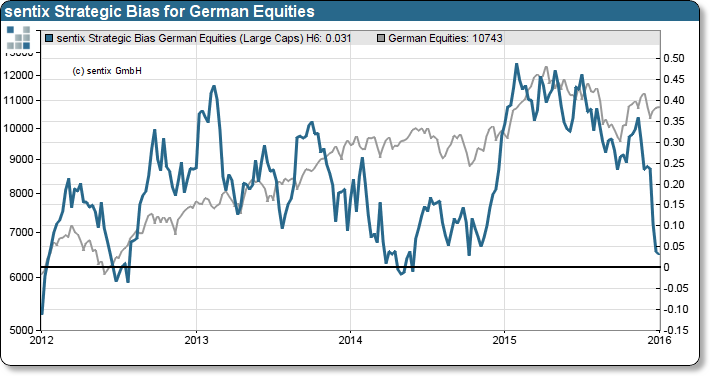

The latest sentix Strategic Bias for German equities, as well as for Chinese and Japanese equities, which measures investor’s market confidence e.g. intermediate-term market expectations (six months), continues trending down-wards as 2015 draws a close. Correspondingly, the indicator for the DAX (German large caps) falls to a 52 week low (see left chart). On the one side, investors react confused about the state of the global economy. Yet on the other side, sluggish growth in China begins to dawn on investors that the rebalancing of the Chinese economy will probably cause collateral damage. The dramatic slump in equity prices across Chinese stock exchanges on the first trading day of 2016, once more confirms the leading attributes of the sentix indicator in predicting significant market turning points. As observed at the beginning of 2015 in case for German equities or in mid of 2015 for the Chinese stock market: significant changes in investors’ market confidence translate into a rebalancing of portfolios.

Therefore, a deterioration in the sentix Strategic Bias should be interpreted as a “bearish” signal for equity markets in the intermediate-term.