|

22 June 2015

Posted in

Special research

49.5% of investors currently expect a “Grexit” to happen within the next twelve months. This is shown by a new survey conducted by sentix over the weekend. At the same time the basic conviction for European stocks rises strongly. Consequently, investors anticipate a “happy end” of the Greek drama. A resumption of the bull market is thus near.

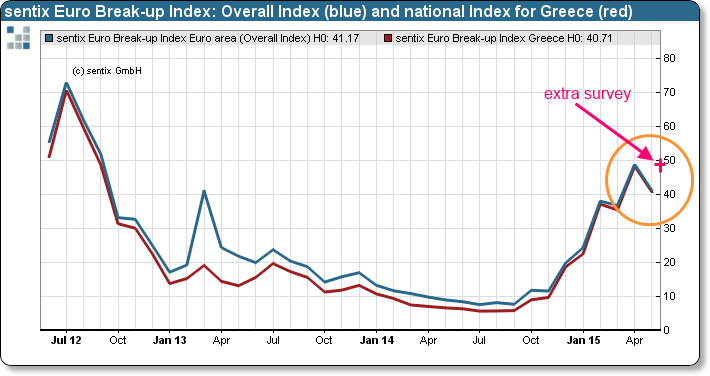

Outside our usual schedule we have asked via the latest sentix Global Investor Survey which share of investors expect Greece to leave the euro zone (“Grexit”) within the next twelve months. The result is 49.5%. At the end of May it was 40.7%, and in April 48.3% – when the index both times was polled via the regular survey on the sentix Euro Break-up Index (see graph).

Consequently, about the same portion of investors expect a “Grexit” as did at the end of April when the Greek topic also was hotly debated. But it surprises that, given the latest deadlock, the number of these market participants is not much higher. Investors obviously anticipate a “happy end” – of whatever kind – of the Greek drama. The assessment is under-scored by a strongly rising sentix Strategic Bias for European stocks, a measure for investors’ basic conviction for a market. This implies that there is a significant risk should things yet turn out badly. But more than this the observed robustness shows that investors are looking through the Hellenic problems. A bull market is thus again in preparation.