|

14 August 2019

Posted in

Special research

In the last three weeks, yields on long-term bonds in particular have come under massive pressure. Since 16 July 2019, the current interest rate for government bonds with a residual term of 30 years has fallen from +0.33% to cur-rently -0.14%. This development is also having an impact on shares in the insurance industry. However, investors have not yet focused on this.

The current sharp decline in long-term interest rates has fuelled the discussion about the current state of the global economy. After leading indicators such as the sentix economic indices have been sending clear recession signals since the beginning of July, the bond markets are now doing the same. Above all, the dramatic flattening of the yield curves is regarded as an unmistakable signal of recession. When in 2000 or 2007/2008 the US yield curve between 10- and 2-year bonds showed an interest rate differential of less than 0%, the downturn and the stock bear market followed.

However, individual sectors are also interest rate sensitive. Obviously, this applies to banks, which are clearly suffering from a flat yield curve. On the one hand, because a flat yield curve makes maturity transformation less profitable for them. On the other hand, because an economic downturn usually leads to increased write-downs on the loan portfolio.

Insurance shares are less in the focus of the general view. These have been the positive exception in the financial sec-tor in recent years and have been able to convince to the end with a moderate outperformance. However, the following chart underlines that this sector is also interest-dependent and that an important turning point could have occurred in July.

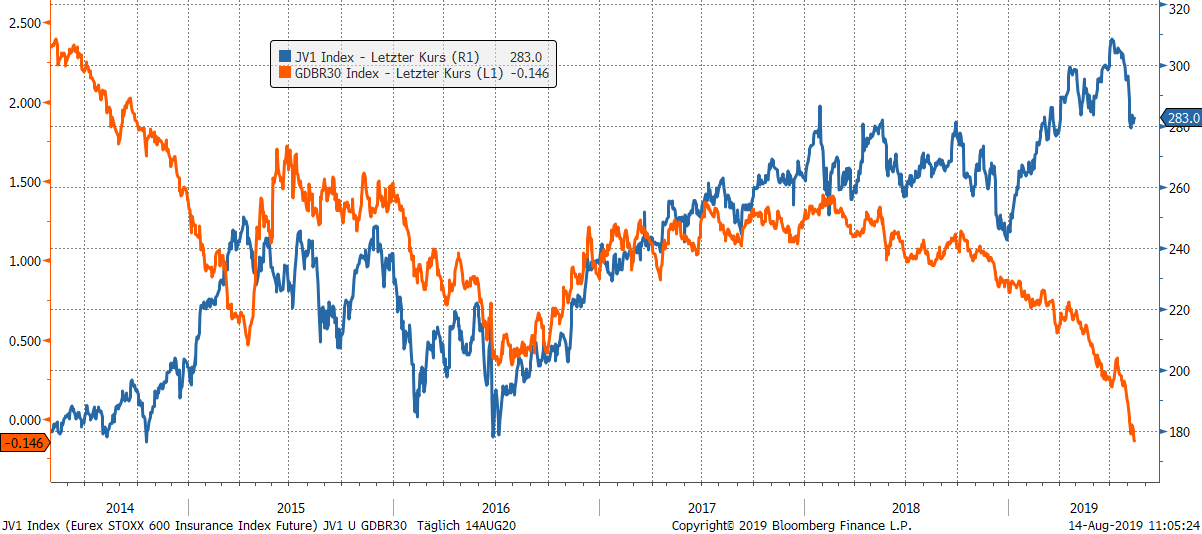

STOXX 600 Future insurance (endless contract) and 30-year interest rates for German government bonds

The chart shows that the decline in long-term interest rates has recently pushed insurance prices down sharply, possi-bly reversing the trend in relative strength.

Insurance companies have considerable investments that they need to cover assumed risks. The valuation of these investments is heavily dependent on interest rates. Directly in the case of bonds and indirectly in the case of equities and other securities.

It is therefore not surprising that, in parallel with the long-term decline in yields since 2008, insurance shares have also gained significantly in value. However, if you look closely, accelerating downward movements in interest rates are usually harbingers of a correction on the bond market and thus a phase of relatively below-average price opportuni-ties for shares in the insurance industry.

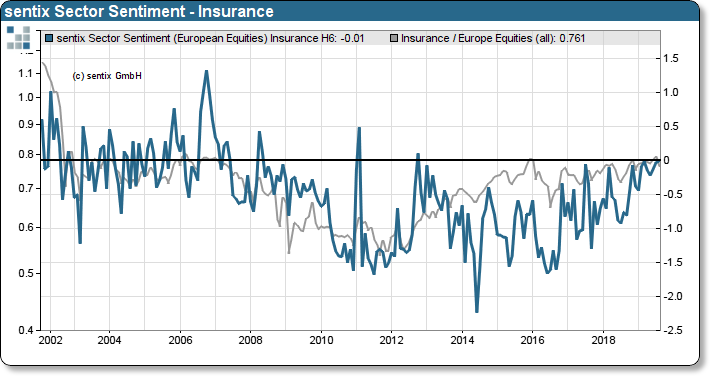

Investors are not yet prepared for such a phase. This is shown by the sentix sentiment sector for insurance companies.

sentix Sector Sentiment Insurance vs. Relative Performance Insurance vs. STOXX 600

Although this notes superficially inconspicuously at the zero line, it is therefore "neutral". But this neutral attitude is at least the most bullish sentiment since 2013. So, the mood is comparatively positive about the sector’s own history. In addition, many investors do not differentiate sufficiently between banks, insurance companies and financial service providers in the financial sector. This means that weak bank sentiment also influences sentiment among other financial companies.

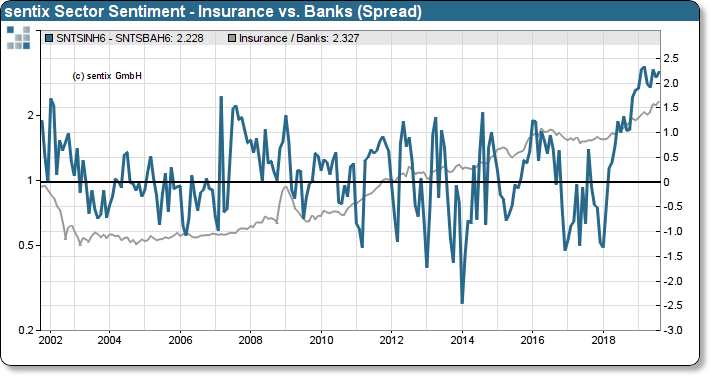

It is therefore worth taking a look at the relative sentiment between insurance companies and banks. This shows that investors are almost euphorically in favor of insurance compared to banks.

sentix Sector Sentiment Insurances to Banks (rel.) vs. Relative Performance Insurances to Banks

This has also been true so far, but the changed interest landscape also sends an unpleasant message to the share-holders of insurance companies. The past clearly shows that the relative performance of insurance companies is bur-dened above all by a rise in interest rates and falling stock markets.

In our blog (https://www.sentix.de/index.php/en/Woolly-thoughts-blog/waiting-for-death.html), we explained that the interest rate market clearly holds out the prospect of one of the two. Investors should thus act more cautiously with insurances.