|

27 February 2018

Posted in

Special research

Professional investors are paid to outperform by clearly positioning themselves against their benchmark. However, many institutional investors are currently retreating to their benchmarks in the "neutral corner". This is an unusual development and cause of a great disorientation - in the short and medium term.

The sentix super-neutrality index, which records the irritation of investors in the short and medium term in one index, reaches a relatively high value of more than 80%. Only three times in the last eight years, investors have experienced greater uncertainty: at the high of June 2017, after the US elections in November 2016 and May 2014. A high neutrality value generally means high irritation and hence volatility in the markets. Investors will not have to endure such an emotional state for long. They are actively searching for a resolution of this dissonance. And as soon as this is found, the portfolios are aligned to the presumably new tendency. This realignment generally leads to significant market move-ments away from the current status quo.

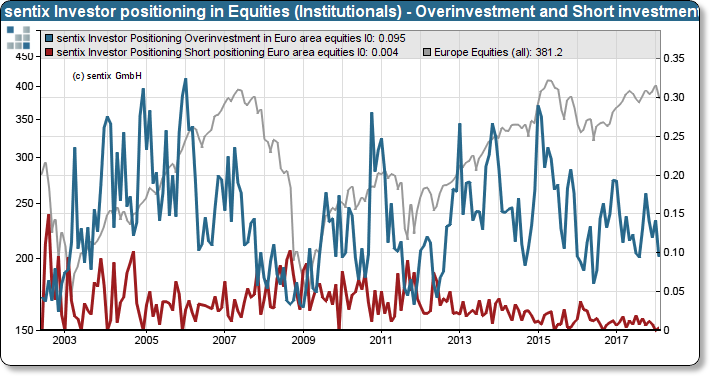

sentix Positioning of institutional investors in shares (over-quota and short-investments)

In the past, such a high risk appetite was often a harbinger of imminent corrections or even trend reversals (see marks on the chart). More and more central banks intend to leave their expansionary course due to the good economic situa-tion. This should increase market volatility. A risky investment behavior could be punished in such a scenario.