|

13 December 2017

Posted in

Special research

In summer 2007, the world of investors was still in order. Equities should rise, interest rates should also rise - and problems such as the looming subprime crisis are best ignored. This recipe for success proved to be a capital failure. Are investors currently making another historic mistake? The danger that show the sentix overconfidence indices, exists at least.

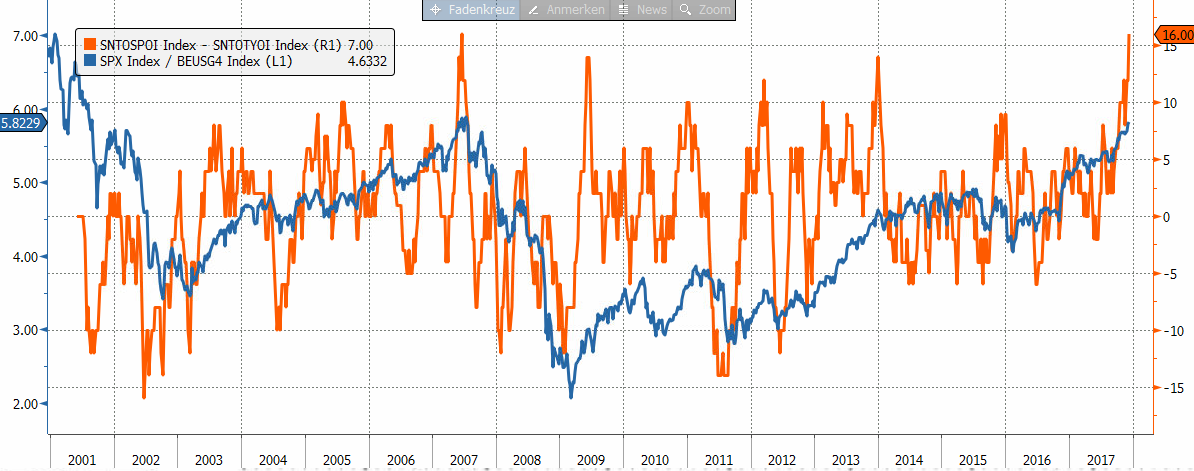

If markets move in only one direction over a longer period of time, investors get the impression of a "biased" market environment. All you have to do is to continue and participate in the prevailing trends. We test such one-sided percep-tion with the sentix overconfidence indices. These are not derived from the sentix survey, but are calculated using a formula that measures the one-sidedness of market movements. The value range of the indicator varies from -13 to +13.

Values of more than +7 signal a dangerous overconfidence, i. e. overestimation of the prospects by investors. Risks in-crease. Values below -7, on the other hand, indicate "underconfidence", i. e. an underestimation of the outlook.

sentix Overconfidence Index US equities (large caps)

Investors take the market to be very bullish and, as the banks' forecasts for 2018 show, this trend is eagerly prolonged into the future.

For US bonds, however, the world looks different. The value here is -7, which means that it seems clear to investors at present that bonds are clearly the worse choice.

Looking at the gap between the equity and bond indicator value, this is currently 16 points. It's an all-time high. This is because the extreme values of equities and pensions that are achieved at the same time are quite rare. Strictly speaking, sentix has only once in its history measured a value of 16 as the difference between equity and bond overconfidence.

And that was in June 2007, on the eve of the financial crisis!

The rest is history. This excessive stock market confidence relative to bonds was severely punished in the following two years. Stocks lost massively relative to bonds. It doesn't have to be that bad this time. Similarly high values in the indicator led to lower equity losses relative to bonds. Incidentally, the absolute direction of stocks and bonds is thus not fixed. The indicator indicates relative performance.

Investors who are interested in investing in the US market should not simply continue to follow existing trends. That would be "overconfident", but certainly take into account for 2018 that stocks are not as unattached as they currently seem!

sentix Overconfidence Index US equities to US bonds (spread) and relative performance S&P500 to US bonds (7-10 years residual maturity)