|

21 March 2016

Posted in

Special research

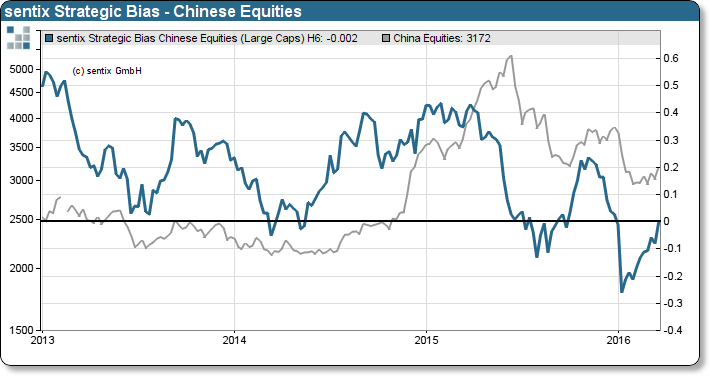

Investors reassess their bearish position on the Chinese equity market. The medium-term expectations have been on the rise since the beginning of 2016. The sentix indicator hints to rising markets ahead.

The latest sentix Strategic Bias for Chinese equities has climbed by 8 percent in comparison to previous week. The indicator hits the zero-line, for the first time since January, which is noteworthy considering the ongoing bear market. The sentix indicator measures investors’ medium term market confidence for a six-month horizon and indicates the general willingness to buy or sell a security. As the latest rise in investors’ willingness to buy improves, it expresses growing confidence, thus, promotes the accumulation of long positions. Subsequent buy orders propel equity prices.

Furthermore, time series analysis underpins that comparably dynamic increases of the sentix Strategic Bias for Chinese equities yielded CSI 300 stock index returns of on average 4.3 percentage points within the subsequent 16 weeks. Hence, the likelihood of a retest of the June 2015 down trend at the 3350 level is high. Should the index even break its downward trend, the market has potential for more gains.