|

24 April 2017

Posted in

Special research

Investors' interest in small and medium-sized companies continues to rise, reaching the highest level since April 2017. While investors are currently relatively modest in terms of their stock quotes, this subindex shows a relatively elevated risk appetite.

Investors' interest in small and medium-sized companies continues to rise, reaching the highest level since April 2017. While investors are currently relatively modest in terms of their stock quotes, this subindex shows a relatively elevated risk appetite.

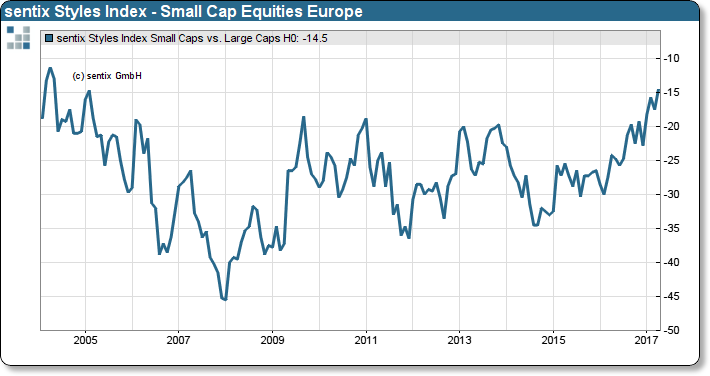

Within the sentix Styles indices, we measure the preference of investors for certain investment themes. In addition to temporal preferences, this index group also includes the preference for small and medium-sized stocks, the so-called small caps. The observation of investor preferences helps to quantify the risk setting of investors. In this case, we as-sume that a preference for small stocks shows greater risk appetite for investors, while a preference for large caps (or blue chips) is more likely to be a more cautious pace for investors.

sentix Styles Index Small Caps Bias

The current survey shows that small caps are currently gaining in popularity. The relative superior performance of this segment should also have contributed to this, as did the economic prospects still favored. This shows that investors are by no means as risk-averse as they would be when looking at relatively moderately invested portfolios. The small caps subindex is also included in the calculation of the sentix risk assessment indices. This index too is currently signaling a relatively elevated risk.