|

13 June 2016

Posted in

Special research

“Brexit” polls heavily influence investors’ opinion on European equities. The latest surge in popularity of the “leave” camp accompanied by falling stock prices dampens the mood. Market participants should brace for further falling stock prices as the referendum approaches. Investors’ sentiment has yet to reach negative extreme value.

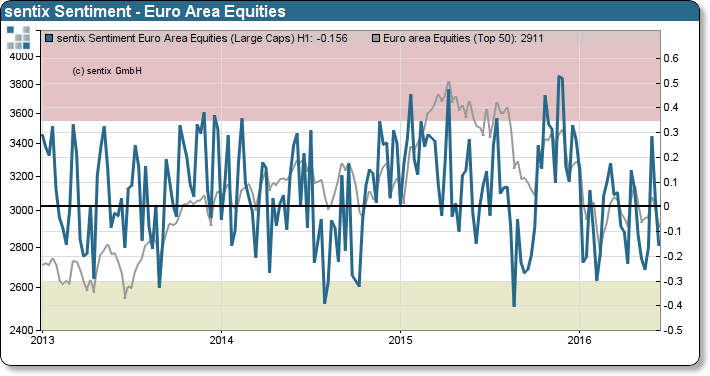

The latest sentix Sentiment Index for European equities in the Euro Stoxx 50 Index falls with -20% back to -0.14 index points. The weak sentiment reflects surging pessimism among market participants as “Brexit” news continue to dominate. The closer the referendum approaches, the more nervous investors react. Nervous investors in turn exhibit volatile sentiment swings (refer to chart). Since at least last week, investors are aware that the outcome of the referendum balances on a knife’s edge. Therefore, investors are forced into hedging positions causing markets to tumble.

Since the latest reaction of investors to “Brexit” polls are unlikely driven by panic and the sentix Sentiment for European equities has not reached extreme parameters yet (refer to chart – green zone), hedging demand has not peaked. Investors should expect a final sell-off. The conditions of major European stock indices support this notion as they exhibit bearish chart patterns.