|

18 January 2016

Posted in

Special research

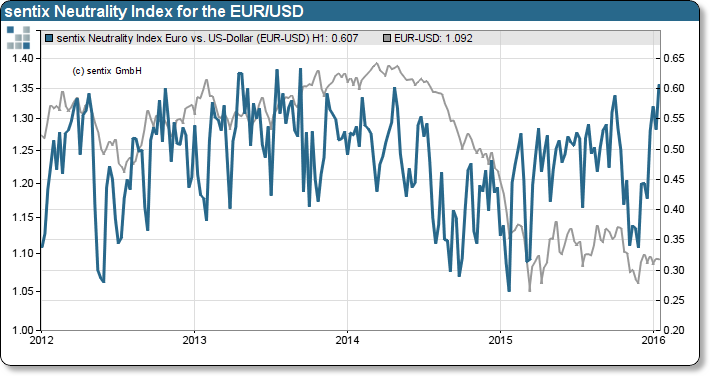

Uncertainty among investors regarding the Euro/US-Dollar exchange rate reaches highest level since 2013 according to the latest sentix Global Investor Survey. Extreme neutrality readings, especially before monetary policy meetings of ECB, Fed and the Bank of Japan, aggravate risks for significant exchange rate fluctuations.

The latest sentix Neutrality Index (short-term) for the Euro/US-Dollar exchange rate, which captures the proportion of investors with neutral market perspectives (one month ahead), continues to rise at the beginning of 2016. Eventually reaching the highest level since 2013. Since the beginning of December 2015 though, the evolving sideways movement of the EUR/USD exchange rate is currently promoted by an equilibrium between interest rate differences and relative economic differences, alike. Interest rate differences on the one side promote the USD: higher interest on US bonds attract return seeking investors, whereby creating demand for USD and putting pressure on the USD to appreciate. On the opposite, the ECB carries on practicing expansive monetary policy, thus creating a relative economic advantage over the US. The rising neutrality/uncertainty among investors predict a quick directional shift. Due to the sentix Neutrality Index characteristics, extreme readings immediately precede changes in volatility and often indicate the end of a trend regime.

Monetary policy meetings of the ECB (21st), the Fed (27th) and the Bank of Japan (29th) are on investors agenda for the remainder of January. Hence, enough potential for volatility in the foreign exchange markets exist.