|

09 November 2015

Posted in

Special research

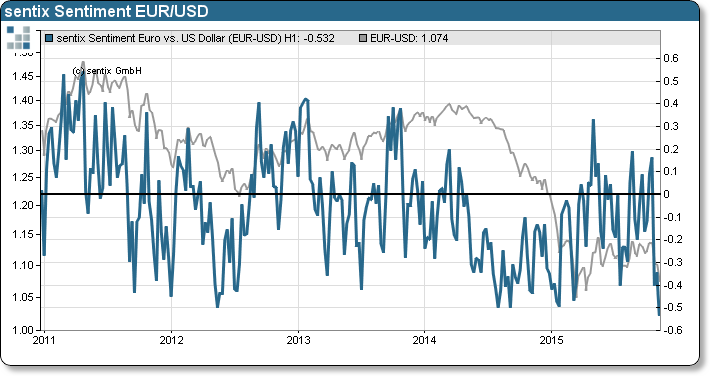

The sentiment of investors towards the Euro falls to an all-time low. The sentix Global Investor Survey shows that the Euro currently faces stronger investors’ pessimism than during the height of the euro crisis. The US Dollar wins investors favour, though.

The latest sentix Sentiment Index for the currency pair EUR/USD, which captures investors one month market expectations, reaches the lowest value since survey interception (please refer to Chart, blue line). Investors have never been more pessimistic about the Euro. Investors rising expectation of an imminent FED rate hike as well as ECB’s intention to expand its quantitative easing program increasingly burden the Euro vs. US Dollar exchange rate. As a result, shifts in the bond markets due to diverging central bank policy put devaluation pressure on the Euro. Technically, low readings of the sentix Sentiment Index offer contrarian opportunities. Hence, an indication of an oversold market. However, prudence is the better part of valour as this contrarian signal needs confirmation. That is currently not given since investors’ medium-term confidence drops simultaneously.

From a technical analysis perspective investors should pay close attention to a retest of last March 2015’s low at 1.05 EUR. Should the EUR/USD currency pair break below support, potential for a move to parity is given.