|

21 September 2015

Posted in

Special research

The latest sentix data set reveals: investors commit in an increasingly strong manner to European equities despite a weakening in economic outlooks and market turbulences. For instance, they increase their investment horizon at a level never seen before. It shows the extreme conditioning of market participants regarding stocks as an investment without any alternative. This is a risk!

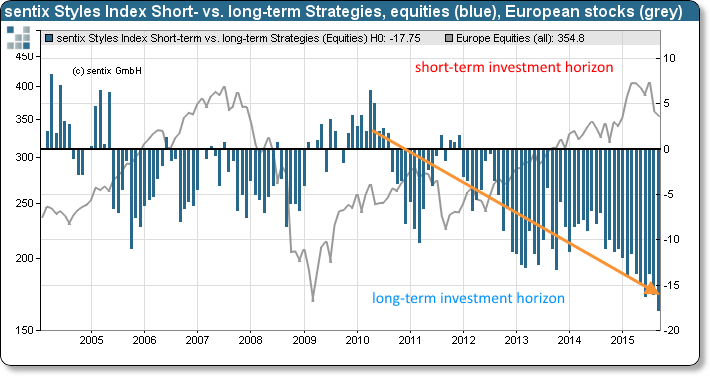

The monthly sentix Styles Index for September regarding the investment horizon for stocks falls to a new record low (see chart below). This means that investors’ intended holding period when buying stocks was never longer than to day (since inception of the indicator in 2004). Furthermore, investors’ basic conviction for equity holdings remains robust. This represents quite an intriguing issue as, at the same time, market participants worry about the global econ-omy and face dramatic stock price developments since recently.

The bottom line is that investors are willing to look through the already risen dark clouds and swear fidelity to equities. This persistent irrational behaviour is an expression of the conditioning investors have undergone by central banks’ ultra-loose monetary policy: in the age of zero interest rates equities are considered being without alternative. Hence, investors are susceptible to new market turbulences – which represents a significant risk!