|

14 August 2018

Posted in

Special research

With the end of the holiday season in Central Europe, investors are also rethinking their minds. Medium-term ex-pectations for shares in the travel and leisure sector are falling significantly. This creates a sales readiness that speaks for an upcoming relative weakness of the sector.

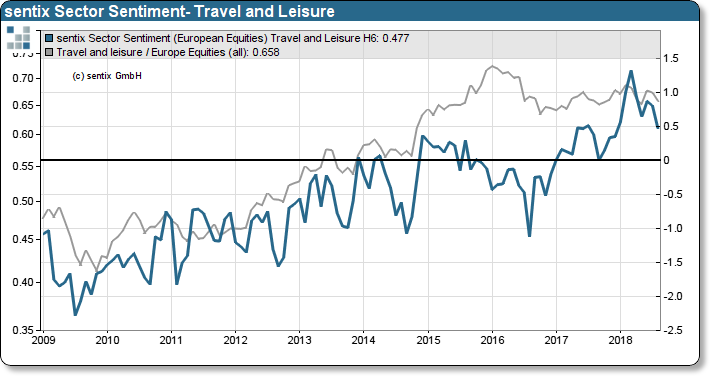

At the beginning of the year, investor sentiment for shares in the travel and leisure industry reached an all-time high. This was tantamount to the end of an almost two-year period of outperformance. Since then, investor sentiment has continued to erode in the medium term. Changes in medium-term expectations reflect - apart from extreme values - changes in investors' basic confidence. In its weekly "Global Investor Survey", sentix surveys over 5,000 investors from more than 20 countries.

sentix sector-sentiment travel and leisure vs. relative performance of sector vs STOXX 600

Changes in basic trust, in turn, are directly related to buying and selling interest. A declining medium-term sentiment therefore points to a willingness to sell.

At the end of the holiday season, the sector is thus losing focus and is likely to perform below average in view of the willingness to reduce its position in the coming weeks. The current crisis in the emerging markets and persistently high oil prices are side effects that support such a scenario.