|

16 June 2014

Posted in

Special research

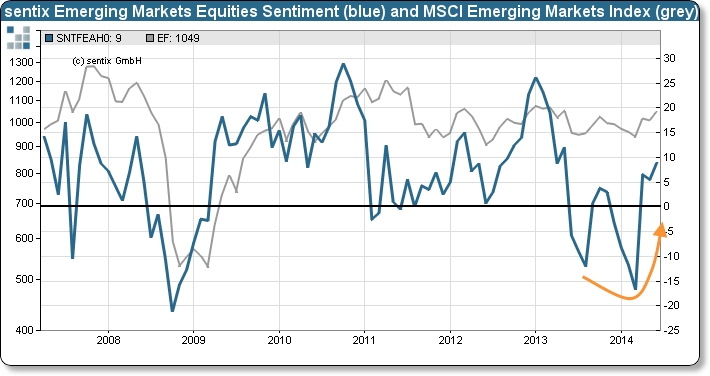

sentix Emerging Markets Equities Sentiment rises in June after a slight setback in the previous month. Investors now have dropped their emerging-markets fears weighing on the asset class at the beginning of the year. This is a positive sign for the future performance of the regions' stocks, all the more as it happens against the emergence of new geopolitical question marks.

sentix Emerging Markets Equities Sentiment rises from 5.5 to 9.0 points in June. This improvement occurs against the background of the advent of new geopolitical question marks like the current developments in Iraq, for instance. But obviously, investors do not perceive them as a dominant burden for the asset class as a whole or, at least, for the heavy weights among the emerging-markets countries. This is a remarkable sign of robustness for investors' expectations. The elections in India, Ukraine's new president and probably even the World Cup in Brazil are currently more important than the still existing geopolitical risks (Iraq, Syria). After the pronounced fears surrounding the emerging markets at the beginning of the year the rebound in stock prices of these regions should now continue.