|

16 October 2018

Posted in

Special research

Automobile stocks have been among the weak stocks on the European stock markets in recent months. Above all, the discussions about driving bans in Germany and the consequences of the diesel affair burdened the car manufacturers, especially the German ones. This uncertainty has recently spread to the market as a whole. This has prompted many investors to make their sector mix more defensive. But now the time may have come for a rethink.

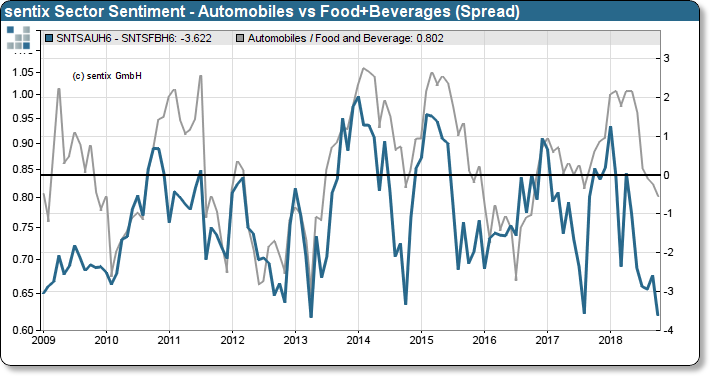

For months now, auto stocks have been the focus of investors - and have been under pressure on the stock markets. This has massively depressed investor sentiment towards vehicle manufacturers. Currently, no sector is viewed relatively more negatively. On the other hand, investors are turning to defensive sectors. All the more so as the market as a whole has now entered a correction. Looking at the relative sector sentiment between the automobile and food+beverage sectors, we measure an almost historical sentiment situation. Only twice, in April 2013 and in summer 2017 the relative sentiment was as low as it is today.

sentix sector sentiment autos vs food+beverages (spread) vs. relative performance automobiles to food+bev. sector

In both cases, car stocks outperformed food+beverages stocks significantly in relative terms. This could happen again in the coming weeks. Don’t drink and drive.

[slide=Background|grey}

sentix Sector Sentiment is a monthly survey conducted since 2002 among individual and institutional investors as part of the sentix Global Investor Survey which runs on the second Friday of each month. Investors are asked about their 6-month expectations regarding 19 European stocks sectors. They can indicate whether they expect a sector to out-perform, to perform as the market or to underperform.

Around 1,000 private and institutional investors participated in the current survey on the sentix Sentiment sector, which was conducted between 11 October and 13 October 2018.

{/slides}