|

19 January 2015

Posted in

Special research

While interest rates continue their fall, the trend that investors buy stocks because of their dividend payments is getting stronger. In January, the sentix index which measures these investor preferences reaches a new extreme. Dividends thus become in an increasingly pronounced manner a substitute for interest rates.

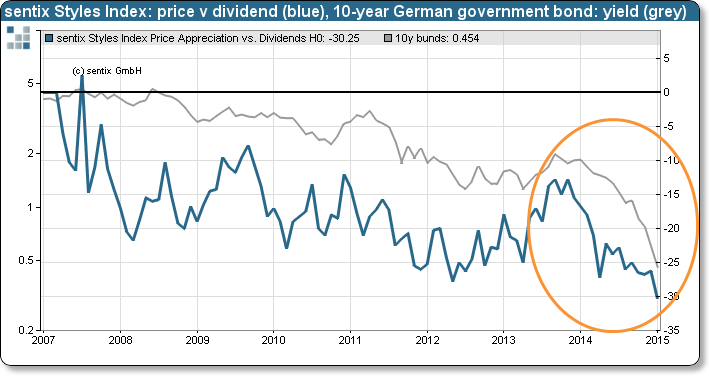

At the year's start, the sentix index measuring the motives when investing in stocks ("sentix Styles Index: price vs. dividends") falls by 4.0 to -30.25 points (see graph). This marks a new all-time low – meaning that when buying a stock investors rate the motive of dividend payments against the motive of price advances as high as never before in the history of the indicator.

Yields of 10-year German government bonds nicely illustrate why investors' desire for dividends reaches such dimensions at the moment: Since the end of 2013 they have fallen from over 2.0% to now under 0.5%. The yield of 5-year bonds is currently even in negative territory. At the same time, the dividend yield of the German DAX 30 still stands at around 2.6%.

The correlation between falling yields and rising preferences for dividends (see graph) demonstrates that equities are becoming more and more attractive for investors as an asset class. This is, by the way, also reflected by other sentix data. Furthermore, the recent rise in sentix economic expectations is a hint that stocks might be very interesting this year also for another reason, namely stronger dynamics in the world economy!