|

06 March 2017

Posted in

Special research

Investors’ confidence in the US equity market suffers. The respective sentix indicator the US market continues its decline. Although investors critically review their stance on equities, stock prices keep rallying. Crash risks are lurking due to this discrepancy.

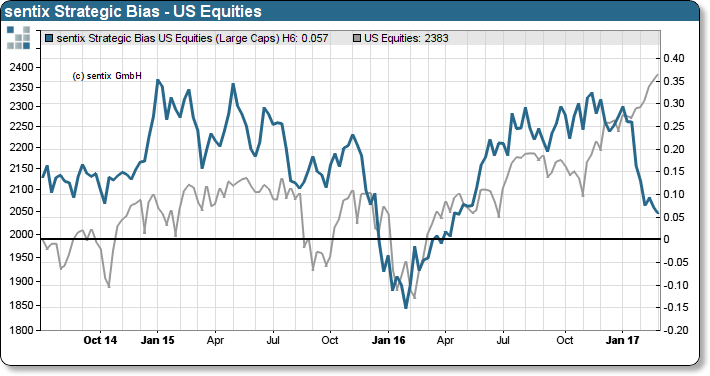

Equity prices, based on the S&P 500 (refer to the chart, grey line), and the sentix Strategic Bias for the US stock market (red line) continue to diverge. As the sentix Strategic Bias expresses investors’ medium-term confidence in the financial markets, it reflects the willingness to buy or to sell positions. An increasing preference to sell usually correlates with a falling level of confidence, and vice versa. Moreover, the latest drop in investor confidence stands in stark contrast with investors’ actions to continue to pour money into the market. The recent CFTC report reveals that investors’ portfolios have accumulated stocks such as a swam soaks water. Hence, the larger the divergence between equity prices (monetarized expectations) and confidence, the higher is the US equity market at risk.

According to experience, such an ambiguous investor behaviour remains a relatively short-term phenomenon. Based on our sentix data, a price correction of, on average, three percent within eight weeks have occurred after situations in which investors similarly lost confidence in the US market. This time, however, we believe that a potential price correction might well exceed those three percent as investors’ portfolios are fully loaded.