|

23 January 2017

Posted in

Special research

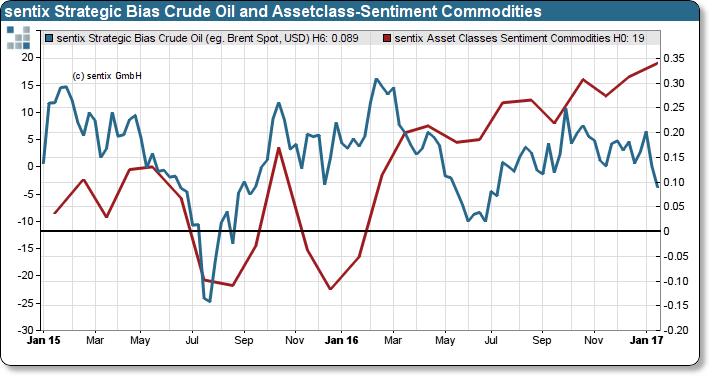

The sentix asset class sentiment for commodities has reached the highest level since 2012. At the same time, investors express falling conviction about further rising crude oil prices. Due to the material interconnection between crude price and the development of all commodities, risks arise.

In comparison to the previous month, the sentix asset class sentiment for commodities rises in January incrementally to 19 points, thus entering bullish overbought terrain (refer to the chart, red line). Normally, the improving sentix indicator heralds a positive commodity price development. However, while the asset class indicator rises, investor’s structural optimism for continuously rising crude oil prices significantly drops. The weekly calculated sentix Strategic Bias for crude oil, which measures investor’s confidence, continues its downtrend (refer to the chart, blue line). The divergence between both sentix indicators highlights mounting risk. The recovery of commodity prices is at stake.

Since early 2016, the recovery of commodity prices follows the lead of rising inflation expectations. Many investors regard investments in commodities as a hedge against rising inflation. Moreover, the driving force behind stronger inflation expectations is a higher crude oil price. As investors now express a lower conviction about further rising crude prices, inflation expectations are possibly under downward pressure, too. Therefore, a falling sentix Strategic Bias for crude oil burdens the entire commodity complex. In our opinion, investors should prepare their portfolios to withstand a consolidation in commodity prices in the weeks to come.