|

19 September 2016

Posted in

Special research

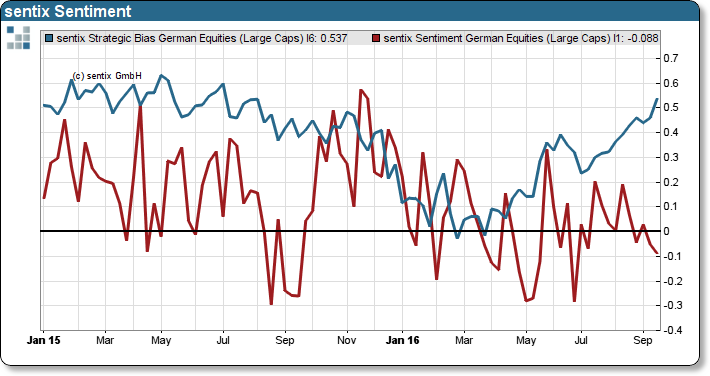

Confidence in German equities jumps to the highest value since a year ago. As professional investors continue to revise their expectations up, their sentiment remains dulled. Historically, the current indicator setup is a bullish sign for a positive development of the DAX stock index over the next weeks.

The latest surge of the sentix Strategic Bias expresses a solid confidence of professional investors in German equities (refer to the chart, blue line). As the sentix indicator measures the expectations of investors over a six-month time horizon, growing confidence among investors is usually a leading indicator of portfolio actions. The latest rise of the indicator, therefore, signalises that investors start gathering on the buy-side, which is remarkable. Recently, investors sentiment was rather pessimistic (refer to the chart, red line). Whether the ECB, the FED or tumbling Deutsche Bank, the list of disappointing news is long.

A statistical analysis backs our hypothesis that in the wake of a combination of weak sentiment and surging Bias the stock market gains: comparable setups in the German stock index DAX have yielded more than 7% over ten weeks after the signal had been triggered. Therefore, the odds for a golden autumn at the German stock market are favourable.