|

17 April 2018

Posted in

Special research

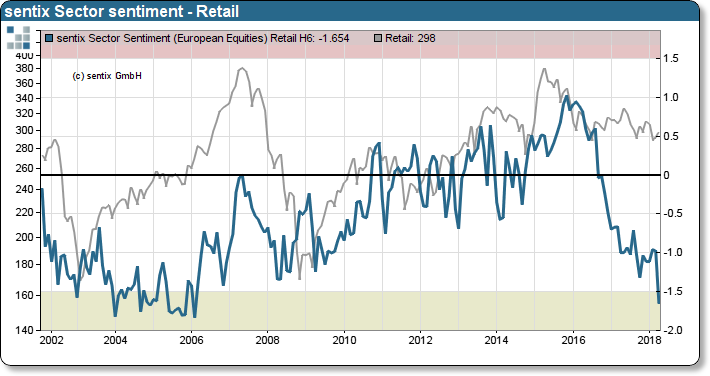

Retail shares are not really generating any storms of enthusiasm among investors at present. On the contrary: the in-vestor sentiment measured by sentix is in the negative range with more than 1.5 standard deviations. This is the lowest value since 2006, but it offers a contrary opportunity!

Investor sentiment towards shares in the retail sector has fallen to its lowest level since 2006. The investors have thus heralded the final sale for the sector. The mood and relative performance have been sinking for about two years. The current mood is therefore the result of a long process of discovery by investors. In addition to company-specific factors, Amazon's triumphant advance has also contributed to this trend. But exactly from this corner a glimmer of hope for the bagged industry could arise. Amazon boss Jeff Bezos is in the crosshairs of US President Trump. Thus his stock could be caught by one or the other Tweet Trumps in the near future.

sentix sector-sentiment retail vs. STOXX 600 Index retail

In addition to the current sentiment signal, the technical constitution also increasingly speaks in favour of a commitment in the retail sector. Relative strength is beginning to improve. The pessimism of investors therefore seems exaggerated and an opportunity.