|

13 July 2015

Posted in

Special research

In July, sentix Sector Sentiment for Europe’s automobile stocks falls more strongly than for any other sector. It is the sorrows concerning a fading demand from China, spurred by the latest market turbulences, which can be felt here. But the positive trend in automobile stocks is still not to be put into question.

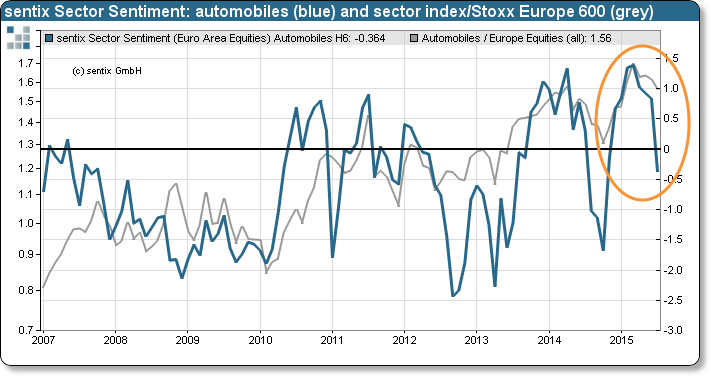

sentix Sector Sentiment for Europe’s automobile sector falls by 1.2 to only -0.36 standard deviations (see “background”). This is an extraordinary setback, in the current month no other sector suffers more strongly. For automobile shares investors now expect an underperformance over the next six months.

An important reason for the worsening in sentiment can be found in the growth market China. There, authorities have – also against the backdrop of the latest stock exchange turbulences – significantly lowered their forecasts for new car sales. But the current consolidation which can be observed in the relative performance of European automobile stocks still looks constructive (see graph). Consequently, we see the cooling in sentiment – which was heavily influenced by the panic-like reaction at the Chinese equity markets – as an opportunity. Thus, the positive trend in Europe’s automobile stocks is – from a sentix point of view – still not to be put into question.