|

14 October 2014

Posted in

Special research

In October, the sentix Sector Sentiment which was polled via the latest sentix Global Investor Survey sends a clear message: investors increasingly like shares of defensive sectors and turn their backs at cyclical stocks. Among these, chemicals shares experience a particularly strong setback in sentiment this month. They now have finally lost their status as "darlings" among investors, but their disenchantment is set to continue.

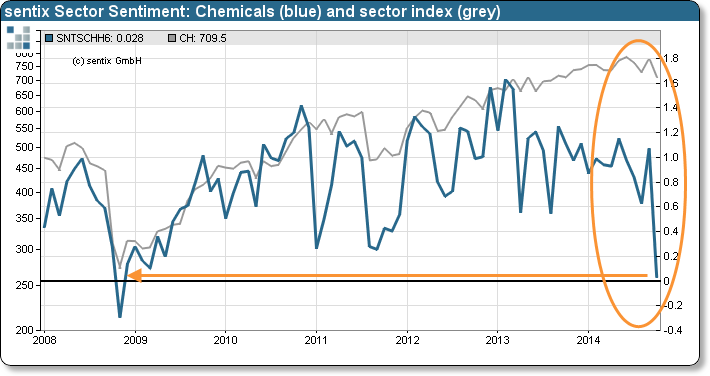

sentix Sector Sentiment for Europe's chemicals stocks falls in October about 1.0 to a now neutral reading of 0.0 standard deviations (see "Background"). For the chemicals sector this is historically an exceptionally strong drop and the lowest reading of its indicator since November 2008!

Rising fears about a material economic slowdown in Europe's and the world's economy – which are also mirrored in the latest sentix Economic Indices – have obviously contributed to finally eroding the chemicals shares' status as investors' darlings. Nevertheless, sentix Sector Sentiment here still shows an average (and thus solid) reading when compared to the rest of the sectors in the sample.

Consequently, sentiment for the chemicals sector has just normalised so far. We expect it to further deteriorate and then to be an additional burden for the sectors' share prices – as besides falling economic expectations a top is currently building in the corresponding index chart. To our minds, the disenchantment of the sector is thus set to continue.