|

04 May 2015

Posted in

Special research

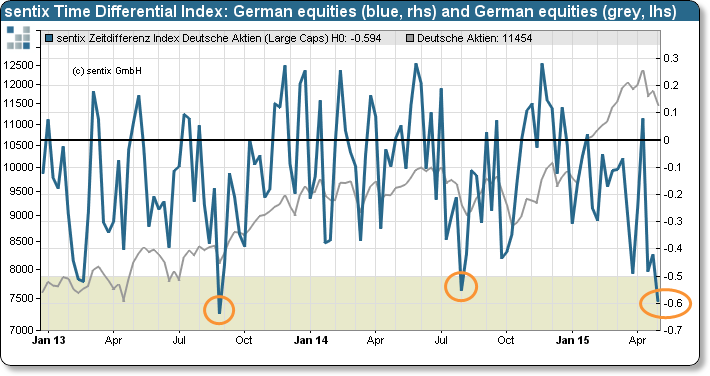

Sentiment for German equities has deteriorated markedly. Currently it is as low as it last was at the beginning of October 2014. But investors’ basic conviction for the asset class increases and now stands close to its record high. As a result, the sentix Time Differential Index sends a clear buying signal!

As the latest sentix Global Investor Survey shows, the sentix Time Differential Index for German equities falls to -0.59%, one of its lowest readings since its inception in 2001. With this, the index sends a clear buying signal! In the past such low readings usually marked the beginning of a phase of newly rising prices. The last two occasions when this happened were at the beginning of August 2014 and in September 2013 (see graph).

The sentix Time Differential Index is calculated as the difference between investors’ (short-term) sentiment and their (medium-term) perception of value. Particularly low readings thus indicate that sentiment is weak in relation to market participants’ value perception of the asset class. And exactly this situation is the one we are facing right now: sentix Sentiment for German equities is as bad as it last was in October 2014. Here, for the first time this year the bears even clearly dominate the bulls. At the same time investors’ basic conviction, i.e. their medium-term perspective, rises further and almost touches new all-time highs. But when short-term sorrows or fears let investors refrain from an asset class although they are fully convinced about its value, this then is a perfect time to invest!