|

18 September 2018

Posted in

Special research

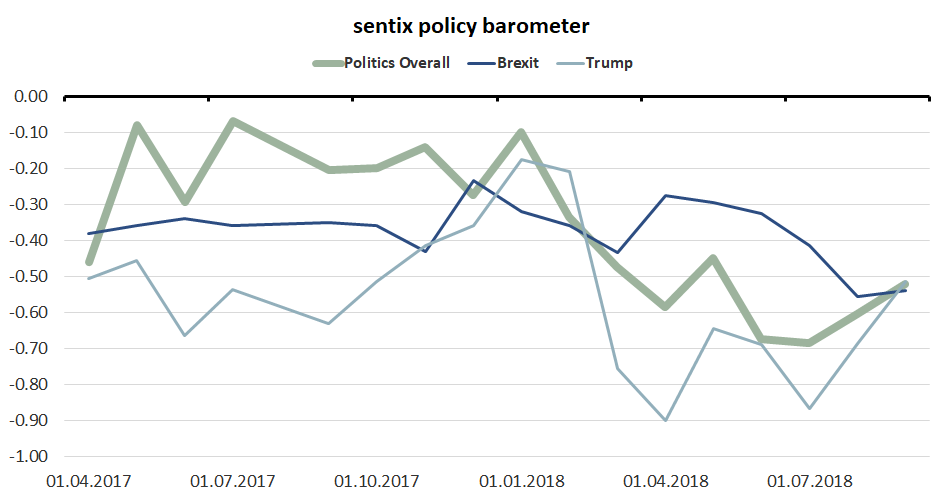

The decided withdrawal of the United Kingdom from the European Union has become the greatest political risk from the point of view of the investors surveyed by sentix in recent months. Increasingly, there are growing signs that there will be no comprehensive new regulation of contractual relations in good time. Even the US president and his trade rhetoric is fading into the background.

The "Brexit", i.e. the withdrawal of the United Kingdom from the EU, is increasingly becoming the focus of investor in-terest. Only about six months remain for the negotiators to regulate the future relationship between the UK and the EU. Too little, the approximately 1,000 investors surveyed by sentix fear. And so, according to the sentix policy barometer, the topic of "brexit" has developed into the greatest political risk for the financial markets - even before the long-running US president. This continues to unsettle the markets by announcing new tariffs against various trading partners.

However, it seems that investors are getting more and more accustomed to this topic. Especially since the impression is growing that Trump is not concerned with isolation, but with removing trade barriers. The tone is rough, but the result is "acceptable" to the financial markets. However, this serenity could turn out to be deceptive, because the nerves of Trump's trading partners eventually lie bare and an exaggerated counter-reaction could overturn the mood again. Polit-ical issues therefore remain a burden on the markets on balance.