|

27 April 2015

Posted in

Special research

As yields approach the zero line for 10-year bunds investors are looking for ever longer maturities. This is the bottom-line from last weekend’s sentix survey on investors’ duration preferences. Their bias for German government bonds with a maturity of more than ten years is currently as strong as never before.

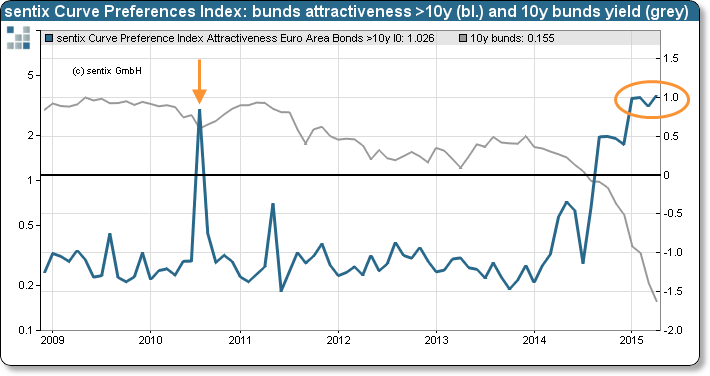

How investors currently glorify the German bond market is best described by this week’s sentix Curve Preference Indices: investors’ preferences for bonds with maturities between 10 and 30 years, for instance, climb to a record high. Only once, in mid-2010, they stood at a similar level. Then, this was the beginning of clear increase in yields (see graph).

As now even 10-year bunds do barely yield more than zero, investors look more and more for ultra-long maturities. These bonds are still more attractive but their yields are on historic lows, too.

The fatal aspect of this development is that investors purchase these securities without any conviction. There is plenty of evidence in our sentix-data universe which is pointing to that: economic and inflation expectations rise, for example. This usually leads to a steepening of the yield curve which is negative (!) for bonds at the long end. Also, we can observe a falling strategic bias for German government bonds. But if investors – knowing that these assets are overvalued – continue to hold or even increase their positions, then there is currently a latent crash danger “working its way” through the bond market.