|

22 May 2017

Posted in

Special research

Since 2013, sentix has regularly measured the expectations of investors towards bitcoins. sentix is thus the only supplier of investor expectations worldwide to this new speculative instrument. The data show that since 2014, the interest of the market in bitcoins has increased systematically. But on the current edge there is a change in expectations, which could lead to a price correction in the "crypto currency".

sentix is the world's first and only provider to offer behavior-oriented data on this new speculative object. Early on we recognized the potential of bitcoins: less as an investment vehicle, but as a speculative object and reincarnation of the tulip bubble in the Netherlands of the 17th century. Already three times have we explained in detail the similarity to so called Ponzi games and explained why a speculative bubble should form. To test this theory and to scientifically docu-ment the formation and bursting of the bubble, we have systematically measured the investor expectations for bitcoins since 2013.

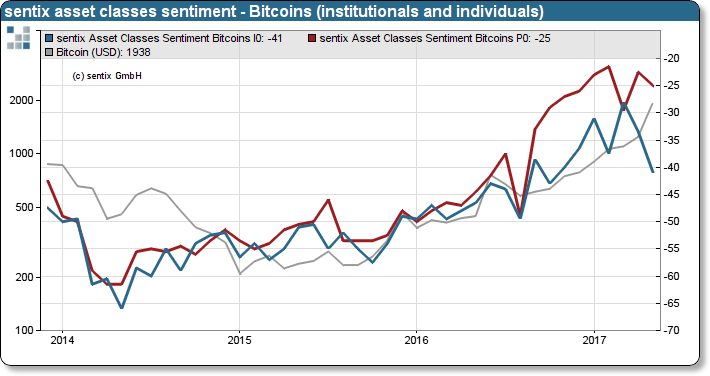

Below is the sentix asset class sentiment, separated by private and institutional investor assessments.

sentix asset classes sentiment to bitcoins (institutional investors versus individual investors), bitcoin in US dollars

In early 2014 the interest in bitcoins was very low. Most, many investors had a decidedly negative opinion here. This has changed significantly in recent years. Above all, with private investors the attitude has changed massively. This change of opinion has also led to a reversal in the negative price trend in 2015.

In 2017, the upward movement has accelerated sharply. We are already in the third speculative exaggeration, which has assumed exponential traits in its price behavior. Such exponential price moves are typical for speculative excesses and regularly mark the approaching end of such exaggeration phases. Just as this applies to the high media interest in bitcoins as an indicator.

There is, however, another reason that could soon lead to disillusionment: the current demolition of institutional inves-tors' assetclass sentiment. This group shows a verifiable loss of confidence in the "crypto-currency", so that profit-taking is more likely.

Investors should also know by far the largest number of bitcoins were "mined" at a time when bitcoins were practically non-existent. The owners of these units are known just as little. The interest in making hard Euros and US Dollars from “bytes and nothing” can always meet this "market".

The fact that the broad mass already recognizes the forming of a bubble and the worthlessness of this speculative ob-ject can, however, be questioned according the state of the public discussion. If you are interested in the data or need information for background research, please contact us!