Appetite for risk is back

Written by Julien Mueller

|

20 March 2017

Posted in

Special research

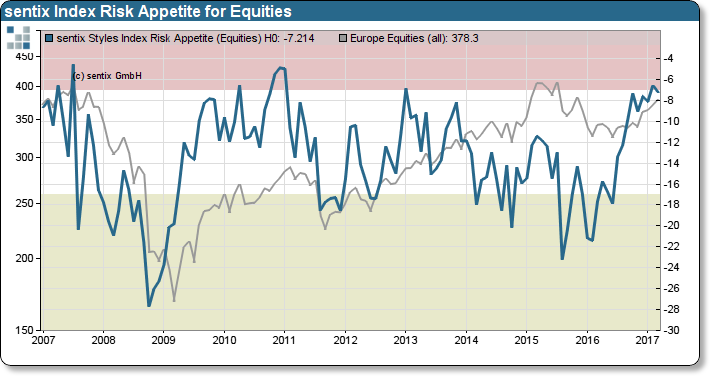

Investors’ risk preference has reached levels last seen in 2011 and before the financial crisis 2007/08. In both cases, the sentix indicator was a warning signal for coming trouble in equity markets.

Recently, investors demonstrate rising appetite for risk. The sentix index for risk appetite, which is set up as a composite of investors preference for asset style and class, has reached with -7 points its extreme upper bound. The last time we could measure comparable risk appetite levels were in the summer of 2007 and at the beginning of 2011. In general, risk levels higher than -6 seldom occur. The more risk seeking behaviour stems from a gradual change in investors attitude towards investment style and asset class. Until recently, investor preferred value-oriented investment strategies. However, investors now favourite growth oriented strategies. In addition to this tilt in investing preferences, investors more and more focus on small cap stocks rather than their “safer” counterparts.

sentix Index Risk Appetite – Equities and STOXX 600 Europe

Perhaps many investors are either unaware or ignore their leveraged preference for risk. Just a few weeks ago, in a one of our weekly sentix survey, most investors undoubtfully expressed that their portfolios are only moderately allocated. Options markets, in contrast, contradict this narrative. As options premiums are falling and implied volatilities settle at record lows, the market indicates investors hold more risk than they normally do. Therefore, investors should watch out for downside risks in the weeks to come.

Background

The sentix Syles Index Risk Appetite (Equities) is a monthly survey based indicator estimating survey participants risk appetite for stocks. The indicator is effectively a composite index of investors preference for a particular asset style and class. Very negative values represent a low-risk appetite whereas higher values represent stronger appetite for risk. In theory, investors favouring value oriented over growth strategies have on average a reduced preference for taking risky bets. Moreover, investors found of small caps tend to be more willing to risk capital than those investing solely in large cap stocks. Hence, investors’ appetite for risk is not only a function of the degree of portfolio investment but also a function of investment style and class.

The current sentix Sentiment survey ran from 16-March to 18-March-2017, and 1.099 retail and institutional investors took part in it.