|

15 September 2014

Posted in

Special research

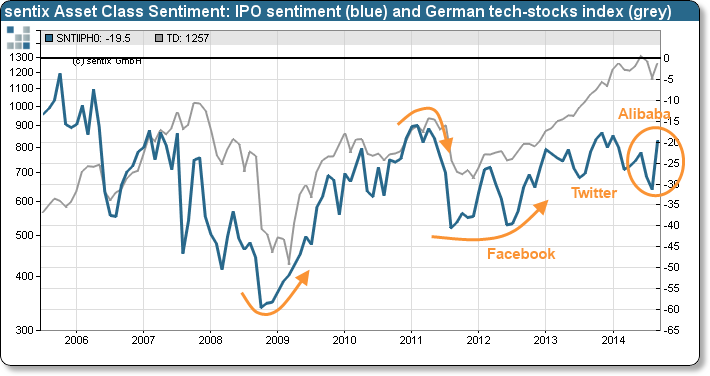

The current sentix Global Investor Survey shows a remarkable development: sentix IPO Senti-ent rises strongly for the first time this year. The improvement of the indicator takes place against the backdrop of the coming US-IPO of Alibaba, a Chinese internet company. This event obviously also has an influence on European investors and lets their readiness to take on new issues rise.

sentix IPO Sentiment climbs by 11.75 to -19.5 points in September. This is a clear counter-movement to the negative tendency which could be observed since the end of last year. The jump in sentiment occurs against the background of the coming US-IPO of Alibaba. The going public of the Chinese internet giant overseas has also opened the eyes of European investors regarding new issues. As a result, the environment for IPOs on this side of the Atlantic – like for Zalando in October, for instance – has improved significantly.

This development has an ironic touch: On the one hand, IPOs are out of fashion since the bursting of the dotcom bubble at the beginning of the century. sentix IPO Sentiment is a good example for this disenchantment as the index has always been in negative territory since its launch in 2005 – meaning that investors since then prefer other asset classes over IPOs. On the other hand, over the past months it is repeatedly internet companies – Facebook 2012, Twitter 2013, Alibaba now – that give investors' sentiment a boost. Obviously, investors' interest in "stories" is back. And this gives issuers more leeway for their pricing.