|

17 October 2017

Posted in

Special research

Prior to the election, investors were still deeply relaxed. What should happen at the Bundestag elections, when the re-election of Chancellor Merkel seemed a safe bet. Now Germany is politically blocked by difficult coalition negotiations in the short term. And the next elections, which are seen more critically, are coming closer now!

Elections were a key concern for investors at the beginning of the year. With the outcome of the Dutch parliamentary elections, and even more so with Macron's election victory in the French presidential elections, this concern has evaporated. To the extent that before the Bundestag election the issue of elections was even recognized as a positive market factor by the investors.

While Angela Merkel still looked like the sure winner before the election, first she must face difficult coalition negotiations, the outcome of which is by no means clear. Neither in the matter, nor less in the content of this political emergency alliance. However, while most political observers ultimately assume that the quadruple alliance is only a matter of time, the same deadline will be the focus of an equally important next election date. The Italian parliamentary elections promise to be more exciting in view of the survey results for Euro-skeptical parties - also or just after the recent election result in Austria.

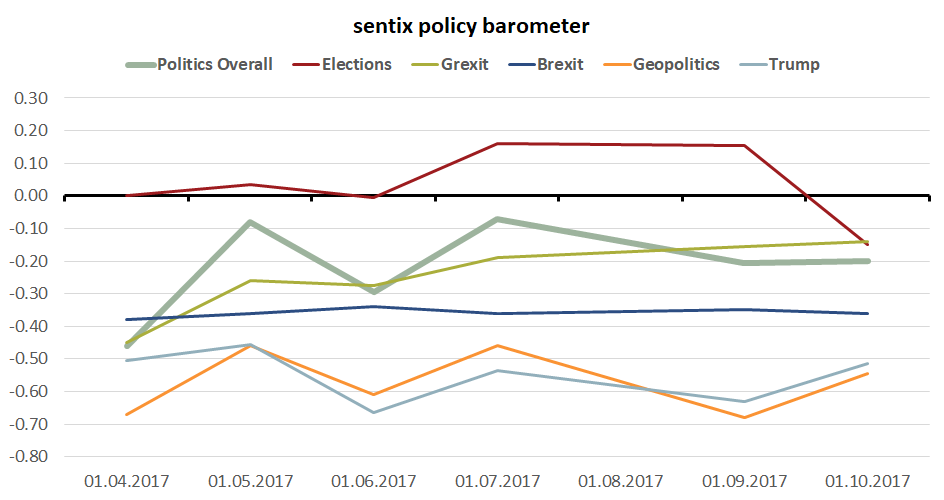

The graph above shows that elections are now seen much more negatively, which should be related to this focus.

The slight improvement in the field of geopolitics is probably since the "rocket man" from North Korea did not provoke any further. Relaxation also looks different. Interestingly in this regard also that investors do not give to indicate that the crisis in Spain seriously concerned them. On the contrary, the fear of a Grexit, a synonym for the euro crisis, continues to decline. Also improved is the sub-index "Trump", which can only be described with the word "habituation effect". In sum, the policy, the overall index shows, is currently rather annoying than a real burden. But the next few weeks promise to remain uneasy, especially for the Eurozone and Europe.