19 February 2014

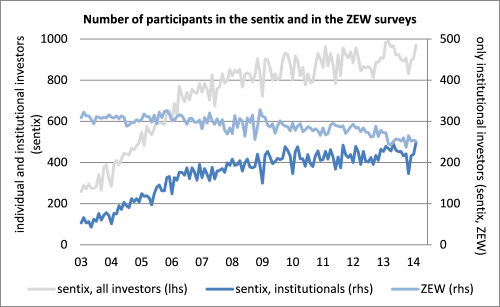

Every month sentix surveys between 900 and 1.000 individual and institutional investors in order to compute its sentix economic index, often dubbed as "sentix investor confidence". The usual perception in this context is that the votes of institutional investors contain more information than those of individual investors' ones. Interestingly, this assumption does not hold if one wants to make estimates for the ZEW economic expectations for Germany or the German ifo business climate, for instance. Here, the assessments of individual investors play a pivotal role.

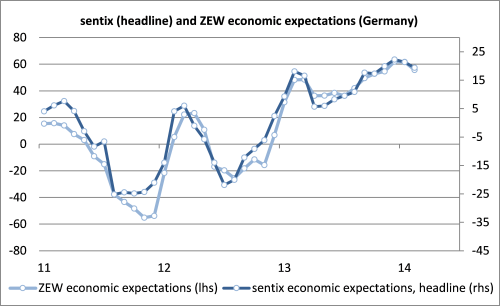

On Tuesday, the February ZEW economic expectations for Germany were released. They surprised the majority of analysts by clearly decreasing. Actually, the February sentix economic index ("sentix investor confidence") for Germany had rather indicated a stagnation of the ZEW index – at least if one looks at the corresponding institutional investors' time series, the one for their 6-month-expectations. Working with this sub-index when making estimates for the ZEW index makes sense theoretically as this subset of investors surveyed by sentix should come closest to the sample surveyed by ZEW.

But a second look at the sentix data reveals that the sentix expectations time series of all investors, including the individual ones, would have done a better job. It has exactly pointed to the observed fall in the February ZEW index. This has prompted us to have, once more, a deeper look into the details of our sentix economic indices.

By doing so, we have found the following surpring results:

1) Concerning Germany, for a few months now the sentix economic expectations of all investors (including indi-vidual ones) are an even better predictor for the ZEW economic expectations than the sub-index of only institutional investors (see graphs below).

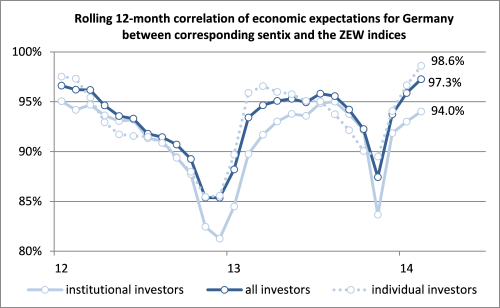

2) The rolling 12-month correlation (comparing indentical months) of the sentix economic expectations of all investors (so-called "headline" expectations) for Germany and the corresponding ZEW economic expectations currently stands at 97.3%, an all-time high.

3) The rolling 12-month correlation (comparing identical months) of the sentix economic expectations of individual investors for Germany and the corresponding ZEW economic expectations stands currently even higher, at 98.6%, also an all-time high.

The graph above shows that the rolling 12-month correlation of sentix economic expectations of individual investors does not always range above the corresponding correlation of the headline index. But, obviously, the expectations of individual investors fulfill a task of stabilising the correlation of the headline index, which – after optical inspection – is dominating the correlations of the two separate sub-indices.

Consequently, the information contained in individual investors' expectations is extremely valuable, if one wants to do estimates for the German ZEW economic expectations (of the same month), for instance. The exact reasons for this are not straight-forward. Possibly, some investors are hiding in the sentix subset of individual investors who also are part of the ZEW sample. Maybe, also the larger size of the sample helps here. But having that said, one has to point to the fact that the sentix subset of institutional investors is now almost as big as the (whole) ZEW sample: In February, 249 institutional investors took part in the sentix survey, and 251 in the ZEW questionnaire (see graph below).

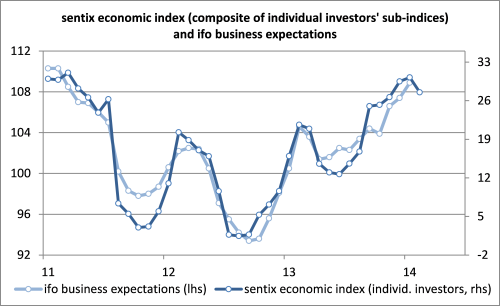

We have made the observation that individual investors' opinions deliver even more precise information when it comes to estimating other economic indices in another context already. For the German ifo business climate the indices of individual investors are a more accurate guidance than those of the professional investors. Here, we think, that it is the fact that individual investors tend to work outside the financial sector, i.e. in the so-called "real economy". While being part of that "real economy" – which is the survey object of the ifo institute – these individual investors absorb relevant information and convey them via participating in the sentix survey into the sentix economic indices. (It is the wisdom of crowds that is at work here.) Thus, a very similar process of information aggregation takes place and is then mirrored in the two fellow indices, the sentix eco-nomic index and the ifo business climate.

For the ifo business climate which is going to be published next Monday, the sentix individual investors' time series point to a decrease of the ifo index of about one point to around 110 points. This development should be driven by the expectations component which can especially well be estimated by using sentix indices of individual investors (see graph).